Lease origination and servicing software for any asset

Launch and service fully customizable lease programs with LoanPro's API-first leasing platform. Automate equipment leasing, automotive leases, and point-of-sale financing from lease origination through payoff.

The end-to-end lease origination and servicing platform for lenders

LoanPro’s composable architecture gives you the flexibility to manage leases your way, with configurability in back-office, agent, and borrower experiences.

Origination Suite

Automate lease origination from application to funded leases with configurable workflows. Seamlessly integrate equipment leasing, automotive finance, and consumer lease programs across the lifecycle.

Modern Lending Core

Track all lease lifecycle events in our Real-Time Ledger while Compliance Safeguard keeps your leasing platform compliant as regulations change.

Servicing Suite

Increase efficiency with automated lease servicing that runs in the background, boosting margins across equipment leasing and automotive finance programs.

Collections Suite

Decrease defaults with flexible payments and hardship programs for past-due lease customers while tracking collateral across leasing portfolios.

Payments Suite

Increase repayment rates with ultimate flexibility across your equipment leasing and automotive lease programs.

The tools necessary for lease and loan management software

Automation Engine

Put lease servicing on autopilot through rule-based automations that run in the background.

Agent Walkthroughs

Create and customize step-by-step guides that lead agents through any process.

Compliance Safeguard

Ensure you’re always compliant with state-by-state regulations through pre-built guardrails in our Modern Lending Core.

Comprehensive Lease Recasting

Easily make any necessary lease modifications to help past-due borrowers repay their lease, decreasing your default rates.

Communications Suite

Engage your customers and build lifelong relationships by automating all communications via text, email, and physical mail.

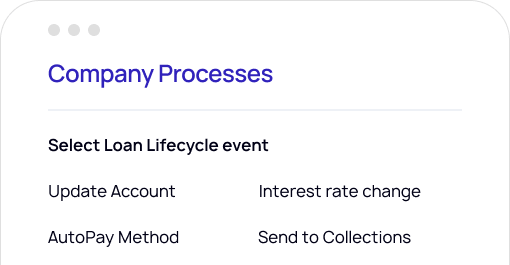

Default processes

Increase operational efficiency by using ready-made processes for common lease life cycle events, from scheduling an AutoPay to repossessing collateral.

Reporting Suite

Monitor every detail of your leasing business by generating timely and accurate reports with LoanPro’s Reporting Suite.

API-first leasing platform

Easily integrate other software and perform automated actions through the Center or Adaptive Wallet API. Build custom lease origination and servicing workflows.

Launch truly differentiated lease programs

LoanPro's API-first leasing platform allows our customers to launch targeted, differentiated equipment leasing and automotive lease programs. Here are a few examples.

Point of sale lease

Tech equipment leasing

Borrower experience:

- Configurable promotional periods: Set up same-as-cash promo periods to reward borrowers for consistent on-time or early payments.

- Automated communication: Send out customized statements and keep borrowers in the loop during every step of the lease life cycle.

- Flexible Collateral Tracking: Simplify collateral tracking by letting borrowers attach multiple items to the same lease contract.

Back-office experience:

- Seamless API connections: Automatically exchange data between LoanPro’s equipment leasing platform and any point of sale system.

- Convenient returns: Streamline returns with flexible tools, no matter how many pieces of collateral are connected to the lease contract.

- Dynamic documents: Create customized templates and generate branded lease documents, from contracts to invoices and beyond.

Installment lease

Automotive installment leasing

Borrower experience:

- Configurable Customer Portal: Design a Customer Portal that fits your brand and configure it for convenient borrower self-service functionality.

- Limitless payment options: Give borrowers total payment flexibility by accepting any payment method imaginable.

- Comprehensive Lease Recasting: Assist borrowers by easily launching hardship programs that are in compliance with all state-by-state regulations.

Back-office experience:

- Easy post-least buyout: Ultra-configurable lease terms make it easy to convert a lease contract into an installment loan.

- Customizable Collateral Tracking: Customize collateral fields to fit your business needs.

- Automated communication: Keep borrowers in the loop on their payoff progress and inform them of options ahead of time.

Create business value with LoanPro’s configurable lease origination and servicing platform

Increase operational efficiency

Automate lease origination and servicing in the background to eliminate manual tasks and increase margins.

Increase customer retention & loyalty

Create experiences that delight customers, such as flexible payment schedules, hardship programs, and more.

Drive growth

Fund more leases by creating differentiated lease programs that attract new borrowers.

Reduce risk

Be confident and compliant with state-by-state regulations using LoanPro’s Compliance Safeguard.

Keep ahead of the game with a leasing platform that does more

API-first

- Configurable, end-to-end leasing software

- Easily compatible with your favorite partners and tools

Compliance

- Keep on top of compliance needs, including SCRA, TILA, Reg Z, and other requirements

- Vetted solutions ensure your road to compliance comes with guardrails

Configurability

- Support any model, from automotive to commercial leasing

- Ensure that your potential for growth is limited only by your imagination, not your software

Scalability

- Scale your business without growing pains

- Support millions of accounts from one, unified leasing system

Related lending and credit programs

Installment loans

Create unique personal installment loans to differentiate in a crowded market.

Credit card

Launch a consumer credit card that is attractive beyond its rewards program with transaction-level credit.

Line of Credit

Quickly launch line of credit programs with unprecedented configurability and flexibility.

Answers to your questions about our lease origination and servicing software

Frequently asked questions

Can LoanPro handle both leases and loans?

What's the difference between lease accounting software and lease management software?

This confuses a lot of people because both deal with leases, but they serve completely different audiences.

Lease accounting software is for companies tracking leases they're paying (lessees). A retail chain with 200 store locations uses this to stay compliant with ASC 842. It calculates balance sheet impacts and generates accounting entries.

Lease management software for lenders is for the companies funding those leases (lessors). Equipment finance companies, automotive lenders, and consumer financing providers use it to originate leases, process payments, and manage collections. LoanPro falls into this category—we're built for lease origination and servicing, not lease accounting.

How does lease origination and servicing automation work?

Automation in lease origination starts when an application comes in. The software can pull credit data, run it through your decision rules, and approve or decline automatically based on criteria you set. If you're integrated with dealer systems or point-of-sale platforms, applications flow directly into your system without manual data entry.

Once a lease is funded, servicing automation takes over:

- Payment processing happens automatically when customers pay

- Past-due workflows trigger based on your rules

- Modification requests route to the right people

- End-of-lease options get presented at the right time

You configure the rules once, and the system executes them consistently across your entire portfolio.

What types of leases does a modern leasing software support?

Lease origination and servicing platforms support equipment leasing (construction equipment, technology, medical devices), automotive leasing (consumer and fleet), and point-of-sale financing. The software handles operating leases, finance leases, and lease-to-own structures.

Worth noting: lease management software for lenders like LoanPro is different from commercial lease management software used in real estate. If you're funding leases rather than managing property leases, you need the lender version that handles origination, servicing, and collections.

What is lease management software in the context for lenders?

Lease management software for lenders is a platform that handles the complete lease lifecycle—from origination through servicing to collections. If you're an equipment finance company, auto lender, or consumer financing provider funding leases, this software manages credit decisions, funding, payment processing, modifications, portfolio management, and reporting.

It's built for lessors (companies funding leases), not lessees (companies making lease payments). Unlike lease accounting software for lessees or property management software for real estate, lease management software in the context for lenders focuses on lease origination and servicing workflows that drive your lending business.

Launch differentiated leases that drive profitable growth.

Talk with our team about how LoanPro can help you grow your lease and lending portfolios today.