Installment loan software that powers any lending program

Complete installment loan software for consumer and commercial lending. Automate origination, servicing, and collections without sacrificing control over your program details.

A unified platform to efficiently launch and service loans

LoanPro’s composable architecture gives you the flexibility to manage loans your way, with configurability in back-office, agent, and borrower experiences.

Origination Suite

Increase your conversion rate from applicants to funded loans with our configurable origination workflows that seamlessly integrate with all other loan life cycle activities.

Modern Lending Core

A reliable foundation that tracks all life cycle events in our Real-Time Ledger while Compliance Safeguard keeps you in the loop as regulations change.

Servicing Suite

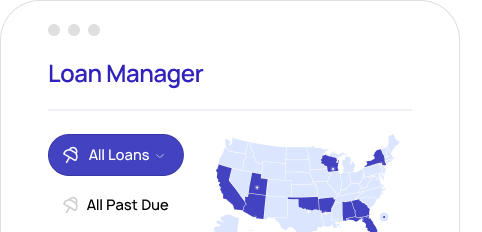

Increase operational efficiency by automating servicing in the background, reducing strain on agents, and empowering customers to self-service their accounts.

Collections Suite

Decrease default rates by providing payment flexibility and hardship programs for customers who are past due on payments.

Payments Suite

Increase repayment rates by providing the ultimate payment flexibility with any payment method imaginable.

The tools necessary to launch fully configurable installment loans

Automation Engine

Put servicing on autopilot through rule-based automations that run in the background.

Agent Walkthroughs

Create and customize step-by-step guides that lead agents through any process.

API Calculator

Increase your conversion rate from applicants to funded loans by embedding our APR calculator in the origination flow.

Comprehensive Loan Recasting

Easily make any necessary loan modifications to help past-due borrowers repay their loan, decreasing your default rates.

Communications Suite

Engage your customers and build lifelong relationships by automating all communications via text, email, and physical mail.

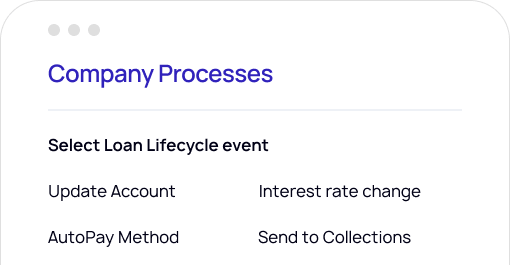

Default processes

Increase operational efficiency by using ready-made processes for common loan life cycle events, from scheduling an AutoPay to repossessing collateral.

Reporting Suite

Monitor every detail of your lending business by generating timely, accurate reports with LoanPro’s Reporting Suite.

API-first, configurable platform

Easily integrate other software and perform automated actions through the Center or Adaptive Wallet API.

Launch truly differentiated installment loan programs

LoanPro’s API-first, configurable architecture allows our customers to launch targeted, differentiated loan programs. Here are a few examples.

Consumer installment loan

Teacher’s installment loan

Borrower experience:

- Payment-free summer breaks: Align payment schedules with teachers’ income schedules to increase repayment rates.

- Incentivize on-time payments: Reward teachers for on-time payment streaks with classroom supplies.

- Help build savings: Allow teachers to make larger payments with excess funds automatically placed in a high-yield savings account that can be accessed over the summer.

Back-office experience:

- Flexible payment acceptance: Accept payments in store, online, or via phone, whether cash, card, check, or ACH.

- Collateral Tracking: In the case of larger purchase financing, lenders can attach multiple pieces of collateral to a loan.

- Comprehensive Loan Recasting: Easily launch hardship programs that are in compliance with all state-by-state regulations.

Business installment loan

Merchant cash advance installment loan

Borrower experience:

- Automated communication: Keep merchants in the loop on payoff progress and inform them of options ahead of time.

- Comprehensive Loan Recasting: Should the need arise, easily modify live loans with full visibility into the Audit Trail.

- Fast funding: Get funds in merchants’ hands fast by pushing to a bank card or account immediately.

Back-office experience:

- Customizable repayment schedules: Create repayment schedules that align with merchants’ needs and your risk profile.

- Easy payment waterfalls: Simplify the profit-principal split by designing allocations upfront.

- Split loan repayments: Streamline repayment by collecting directly, or through split withholdings.

Create business value

with LoanPro’s configurable lending and credit platform

Increase operational efficiency

Automate servicing in the background to eliminate manual tasks.

Increase customer retention & loyalty

Create experiences that delight customers, such as flexible payment schedules, hardship programs, and more.

Drive growth

Fund more loans by creating differentiated loan programs that attract new borrowers.

Reduce risk

Be confident and compliant with TILA and other regulations using LoanPro’s Compliance Safeguard.

Keep ahead of the game with a lending platform that does more

API-first

- Configurable, end-to-end platform

- Easily compatible with your favorite partners and tools

Compliance

- Keep on top of compliance needs, including SCRA, TILA, Reg Z, and other requirements

- Vetted solutions ensure your road to compliance comes with guardrails

Configurability

- Support any installment loan model, from automotive, to business-to-business, to personal unsecured

- Ensure that your potential for growth is limited only by your imagination, not your software

Scalability

- Scale your business without growing pains

- Support millions of accounts from one, unified system

Related credit programs

Line of Credit

Quickly launch line of credit programs with unprecedented configurability and flexibility.

Credit card

Launch a consumer credit card that is attractive beyond its rewards program with transaction-level credit.

Answers to your questions about LoanPro’s modern lending and credit platform

What payment methods does LoanPro support?

LoanPro supports cash, check, card, and bank account payments, and offers you the flexibility to create new payment methods that apply to your lending business.

Can I issue installment loans and lines of credit?

Yes. Issue and service both installment loans and lines of credit within LoanPro as your single lending and credit platform. Link the accounts to each other and to the same borrowers to drive growth and increased loyalty among your existing customers.

How does LoanPro help me stay compliant?

Compliance Safeguard provides one-click compliance tools that let you align accounts with regulatory requirements, reducing the risk of mistakes, fines, and lawsuits.

Can I customize automatic communications?

Yes. Use Dynamic Templates to ensure communications fit your brand and drive customer engagement.

Launch differentiated installment loans that drive profitable growth.

Talk with our team about how LoanPro can help you achieve your business objectives.