Increase funded loans with LoanPro’s Origination Suite

Optimize your origination process with a fully integrated Origination Suite and dynamic servicing features in LoanPro’s API-first lending and credit platform.

Problems with legacy origination systems

Mismatched calculations

TILA disclosures calculated by the origination system can be inconsistent with the calculations in your servicing system.

Rigid data gathering

Long, manual application processes lead to low application-to-funded loan ratios.

Disjointed processes

Using multiple systems not only wastes time, but also introduces compliance and privacy liabilities.

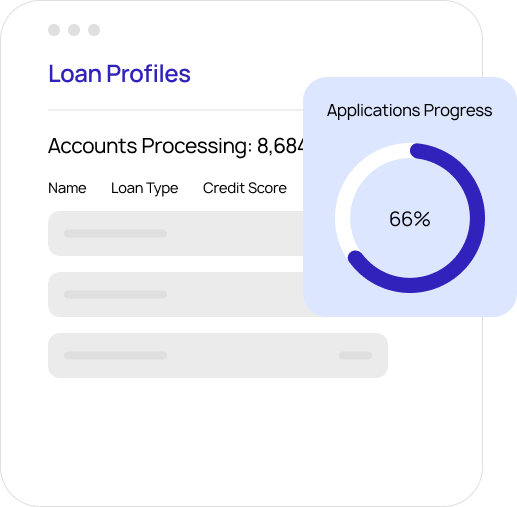

Increase funded loan volume with LoanPro’s Origination Suite

Instant and accurate calculations

Ensure that all calculations, disclosures, and closing documents are perfect and consistent through the entire credit life cycle.

Highest conversion rates

Streamline the application process to ensure you’ve funded as many loans as possible based on your application volume.

Unified platform

A single platform to improve agent, borrower, and back-office servicing experiences.

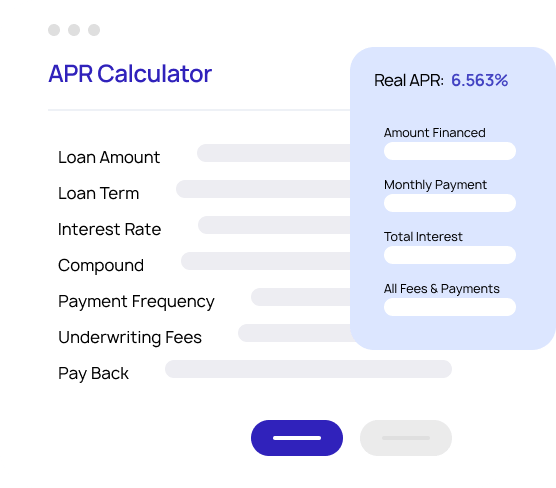

LoanPro’s API Calculator

By allowing borrowers to dynamically adjust loan terms and instantly visualize the financial impact, you'll:

- Boost financial literacy

- Reduce application abandonment

- Drive portfolio growth

The value that 600+ lenders achieve through LoanPro

Increase operational efficiency

Leverage custom automations to move accounts through the origination cycle based on your business logic.

Increase customer retention & loyalty

Attract customers with deep configurability and truly differentiated credit products.

Reduce risk

Keep your data in one system from application to payoff, always protected by Compliance Safeguard.

Accelerate loan growth

With LoanPro’s scalable architecture, expanding your portfolio will never slow you down.

The tools you need to streamline and enhance your origination process

LoanPro’s Origination Suite provides everything you need to centralize and simplify origination, leading to a delightful applicant experience and an increase in return customers.

API Connectivity

Seamlessly integrate any acquisition, underwriting, or decisioning tool into our API-first architecture.

API Calculator

Connect LoanPro’s best-in-class calculator to your application, allowing borrowers to see dynamic rates and payment schedules.

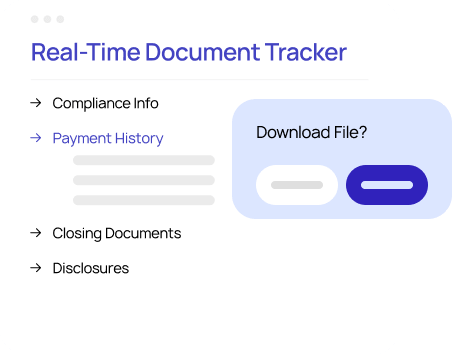

Dynamic Documents

Instantly generate and send contracts, closing docs, disclosure forms, and welcome packages that automatically merge in borrower and account data.

Personalized Application

Give potential customers direct access to their application, allowing them to enter and edit personal info, payment details, and origination documents.

Flexible Funding

Disburse funds and issue credit cards through LoanPro’s fully integrated payment partners.

Customer Conversion

Use our Automation Engine to identify reliable borrowers and offer them advancements or new accounts, turning one-time customers into recurring ones.

Customer Conversion

Use our Automation Engine to identify reliable borrowers and offer them advancements or new accounts, turning one-time customers into recurring ones.

Flexible Funding

Disburse funds and issue credit cards through LoanPro’s fully integrated payment partners.

Personalized Application

Give potential customers direct access to their application, allowing them to enter and edit personal info, payment details, and origination documents.

Dynamic Documents

Instantly generate and send contracts, closing docs, disclosure forms, and welcome packages that automatically merge in borrower and account data.

API Calculator

Connect LoanPro’s best-in-class calculator to your application, allowing borrowers to see dynamic rates and payment schedules.

API Connectivity

Seamlessly integrate any acquisition, underwriting, or decisioning tool into our API-first architecture.

What our 600+ customers say about LoanPro

Chief Operating Officer

LoanPro is never our long pole. We know that we are at the stage where anything is entirely possible, and it wasn't with our previous platform.

Operations Platform Owner

With the product that the agents were using before, they had to toggle in a lot of different places to efficiently service loans. LoanPro brought that all into a single place.

Chief Operating Officer

It's good to have a strong partner that focuses on technology and building an infrastructure platform. We get more leverage out of having a partnership than building something internally.

The modern, API-first origination platform

API-first platform

- Portable calculator that can be used within any system

- Easily integrate existing systems with the Origination Suite

Fully integrated platform

- One, holistic platform that seamlessly integrates all credit life cycle events from origination to final payment

- Seamlessly connect origination and servicing

Unlimited flexibility and scalability

- A platform that supports virtually every class of loans, lines of credit, and credit cards

- Automation Engine turns your business rules into reality, automatically sending notifications, updating calculations, and moving accounts through your custom workflows

Additional components of LoanPro's unified credit and lending platform

Modern Lending Core

A reliable foundation that tracks all lifecycle events in our real-time ledger while using Compliance Safeguard to keep you in line with updated regulations.

Collections Suite

Provide payment flexibility and hardship programs for customers who are past-due on payments.

Payments Suite

Setup AutoPay and provide ultimate payment flexibility with any payment method imaginable that’s supported in LoanPro.

Servicing Suite

Unlock your lending potential by efficiently servicing any class of loans with deep, API-first configurability and robust automation.

Upgrade your origination process with LoanPro.

Talk with our team about your organization’s lending and credit objectives today.