Loan Origination Software that drives approvals and conversions

Streamline your origination process with an integrated Loan Origination System and powerful servicing features, all within LoanPro’s API-first lending and credit platform.

Problems with legacy loan origination systems

Mismatched calculations

TILA disclosures calculated by the loan origination system workflows can be inconsistent with the calculations in your servicing system.

Rigid data gathering

Long, manual application processes lead to low application-to-funded loan ratios.

Disjointed processes

Using multiple systems not only wastes time, but also introduces compliance and privacy liabilities.

Increase funded loan volume with LoanPro’s Loan Origination Platform

Instant and accurate calculations

Ensure that all calculations, disclosures, and closing documents are perfect and consistent through the entire credit life cycle.

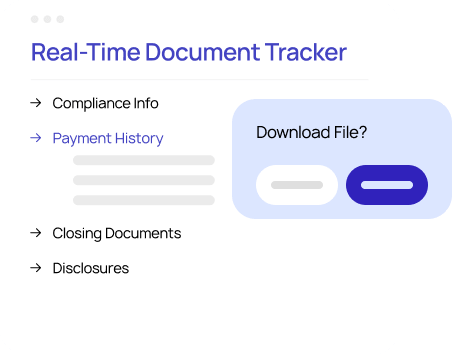

Highest conversion rates

Streamline the application process to ensure you’ve funded as many loans as possible based on your application volume.

Unified platform

A single loan origination platform to improve agent, borrower, and back-office servicing experiences.

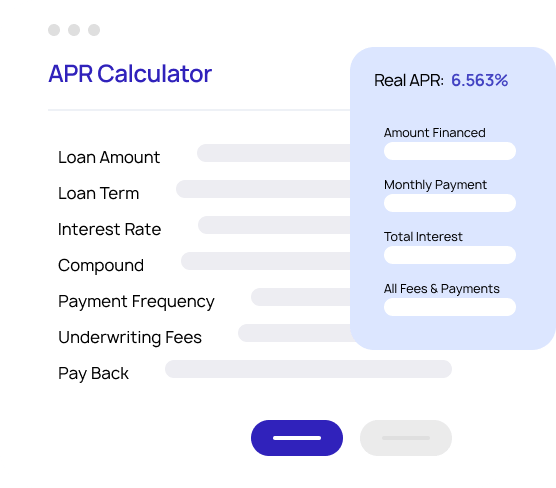

LoanPro’s API Calculator

By allowing borrowers to dynamically adjust loan terms and instantly visualize the financial impact, you'll:

- Boost financial literacy

- Reduce application abandonment

- Drive portfolio growth

The value that 600+ lenders achieve through LoanPro

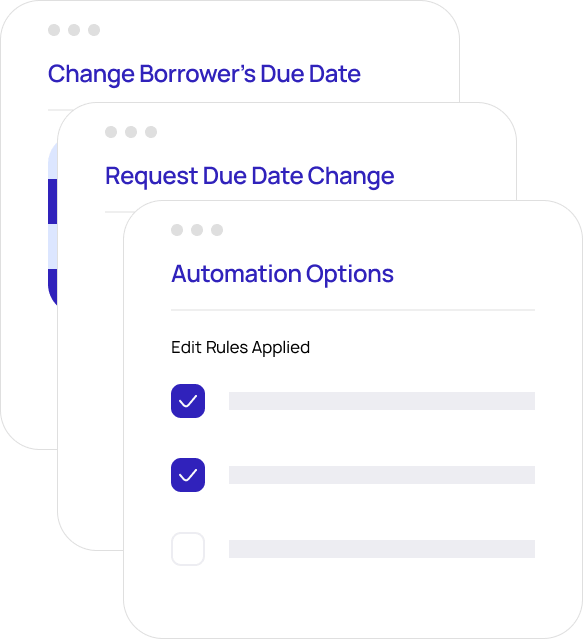

Increase operational efficiency

Leverage custom automations to move accounts through the loan origination cycle based on your business logic.

Increase customer retention & loyalty

Attract customers with deep configurability and truly differentiated credit products.

Reduce risk

Keep your data in one system from application to payoff, always protected by Compliance Safeguard.

Accelerate loan growth

With LoanPro’s scalable architecture, expanding your portfolio will never slow you down.

The tools you need to streamline and enhance your loan origination systems

LoanPro is the best loan origination software to centralize and simplify your workflows, leading to a delightful applicant experience and an increase in return customers.

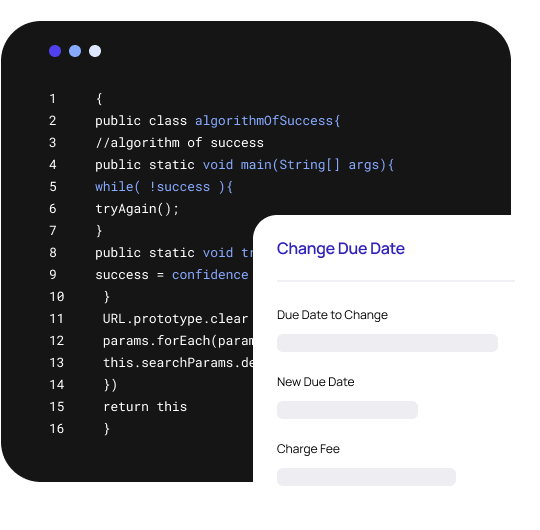

API Connectivity

Seamlessly integrate any acquisition, underwriting, or decisioning tool into our API-first architecture.

API Calculator

Connect LoanPro’s best-in-class calculator to your application, allowing borrowers to see dynamic rates and payment schedules.

Dynamic Documents

Instantly generate and send contracts, closing docs, disclosure forms, and welcome packages that automatically merge in borrower and account data.

Personalized Application

Give potential customers direct access to their application, allowing them to enter and edit personal info, payment details, and origination documents.

Flexible Funding

Disburse funds and issue credit cards through LoanPro’s fully integrated payment partners.

Customer Conversion

Use our Automation Engine to identify reliable borrowers and offer them advancements or new accounts, turning one-time customers into recurring ones.

Customer Conversion

Use our Automation Engine to identify reliable borrowers and offer them advancements or new accounts, turning one-time customers into recurring ones.

Flexible Funding

Disburse funds and issue credit cards through LoanPro’s fully integrated payment partners.

Personalized Application

Give potential customers direct access to their application, allowing them to enter and edit personal info, payment details, and origination documents.

Dynamic Documents

Instantly generate and send contracts, closing docs, disclosure forms, and welcome packages that automatically merge in borrower and account data.

API Calculator

Connect LoanPro’s best-in-class calculator to your application, allowing borrowers to see dynamic rates and payment schedules.

API Connectivity

Seamlessly integrate any acquisition, underwriting, or decisioning tool into our API-first architecture.

What our 600+ customers say about LoanPro’s Loan Origination Platform

Chief Operating Officer

LoanPro is never our long pole. We know that we are at the stage where anything is entirely possible, and it wasn't with our previous platform.

Operations Platform Owner

With the product that the agents were using before, they had to toggle in a lot of different places to efficiently service loans. LoanPro brought that all into a single place.

Chief Operating Officer

It's good to have a strong partner that focuses on technology and building an infrastructure platform. We get more leverage out of having a partnership than building something internally.

The modern, API-first loan origination platform

API-first platform

- Portable calculator that can be used within any system

- Easily integrate existing systems with the Origination Suite

Fully integrated platform

- Seamlessly integrates all credit life cycle events from origination workflows to final payment

- Connect through one, holistic loan origination and servicing software

Unlimited flexibility and scalability

- A platform that supports virtually every class of loans, lines of credit, and credit cards

- From banking and auto to consumer and commercial loan origination

- Automation Engine automatically sends notifications, updates calculations, and moves accounts through your custom workflows

Additional components of LoanPro's unified credit and lending platform

Modern Lending Core

A reliable foundation that tracks all lifecycle events in our real-time ledger while using Compliance Safeguard to keep you in line with updated regulations.

Collections Suite

Provide payment flexibility and hardship programs for customers who are past-due on payments.

Payments Suite

Setup AutoPay and provide ultimate payment flexibility with any payment method imaginable that’s supported in LoanPro.

Servicing Suite

Unlock your lending potential by efficiently servicing any class of loans with deep, API-first configurability and robust automation.

Frequently asked questions

What is loan origination system (LOS)?

A loan origination system (LOS) is a centralized, digital loan origination platform used to manage the process of applying for a loan, underwriting, and funding. A modern LOS, like LoanPro's, is defined by its API-first architecture. This is essential because it allows the lender to seamlessly connect the platform to any third-party tool, from application portals to fraud checks and decision engines, ensuring complete control over the workflow and enabling customized product creation.

Can this origination platform handle complex commercial and B2B lending requirements?

Yes, LoanPro is a powerful commercial loan origination software. The platform's deep configurability supports the specialized needs of corporate loan origination systems, including complex entities, varied collateral, customized payment schedules, and sophisticated credit structures like lines of credit and leases. LoanPro’s ability to manage virtually any class of loan makes it ideal for B2B term loans, commercial auto, and inventory finance.

What data is accessible via the LoanPro origination API?

The robust loan origination API provides real-time access to all loan, application, and customer data. This is crucial for automation, allowing third-party tools (like decision engines or CRM) to ingest and update applicant data instantly, enabling seamless underwriting and reducing the loan origination systems' reliance on manual data transfer.

How does loan origination work and what are the key stages?

The LoanPro platform supports all critical stages of how loan origination works:

- Application Intake (via third-party portal integration).

- Underwriting & Decisioning (via integrated decision engine).

- Offer Generation (automated and configurable).

- Closing & Funding (automated disbursement).

- Servicing Handoff (instant, real-time creation of the loan account).

How does the platform ensure compliance and fraud prevention during application intake?

The Loan Origination Platform is compliance-aware, integrating checks for regulations like SCRA and TILA. For fraud and identity verification, it uses the API-first model to quickly connect with LoanPro’s Smart Verify tool, ensuring that OFAC compliance and other checks are automated and completed before the loan moves to funding.

Upgrade your loan origination systems with LoanPro.

Talk with our team about your organization’s lending and credit origination system today.