Unlock financial innovation with LoanPro’s Modern Lending Core

No more long cycles to configure new products or inability to access your data. LoanPro’s API-first Modern Lending Core transforms each step of your credit life cycle with robust configurability and automation.

Problems with legacy cores

Limited API functionality

Legacy cores lack the necessary API infrastructure to enable you to plug other components into your lending core and launch products and features quickly.

Operational inefficiency

A lack of automation tools creates bottlenecks for agents and impacts customer satisfaction.

Inflexible data access

Accessing data requires multiple manual steps and oftentimes isn’t accurate or updated in real time.

Unlock financial innovation with LoanPro’s Modern Lending Core

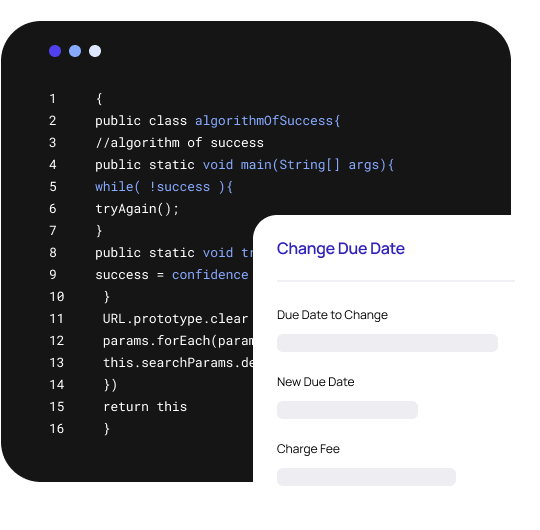

Modern, API-first architecture

Experience a core with a robust API architecture that provides the ultimate flexibility and configurability to launch new products within two weeks.

Automated servicing and management

LoanPro’s Automation Engine manages and services loans in the background, reducing agent workload and delighting customers.

Immediate access to your data

Access your data at your convenience with Data on Demand to ensure your portfolio is healthy and in compliance with regulations.

The value that 600+ lenders achieve through LoanPro

Increase operational efficiency

Increase agent productivity and decrease agent-to-loan ratios with increased automation.

Increase customer retention & loyalty

Delight customers by servicing their credit product on autopilot with Automation Engine.

Reduce risk

Complete data visibility and Compliance Safeguard equip you with the tools you need to stay compliant.

Accelerate loan growth

Stay ahead of the market by launching limitless products to capture specific segments of the market.

The tools available in LoanPro’s API-first Modern Lending Core

Whether you’re replacing your legacy system or using LoanPro as a shadow core, LoanPro empowers you with the configurability and flexibility you need to bring new products to life.

Real-Time Ledger

Track every account life cycle event with confidence that the data is always real time and accurate.

Data on Demand

Choose the reports you want, when you want them, and let LoanPro’s automation do the rest.

Real-Time Replicated Database

Receive direct access to a read-only database to query at any time, for any reason.

Logic-Based Fields

Instantly calculate and display the information your agents need, based on your own custom logic.

Document Management

Oversee borrower and account documents so that nothing slips through the cracks.

Real-Time Ledger

Track every account life cycle event with confidence that the data is always real time and accurate.

Data on Demand

Choose the reports you want, when you want them, and let LoanPro’s automation do the rest.

Real-Time Replicated Database

Receive direct access to a read-only database to query at any time, for any reason.

Logic-Based Fields

Instantly calculate and display the information your agents need, based on your own custom logic.

Document Management

Oversee borrower and account documents so that nothing slips through the cracks.

Reporting Suite

Comprehensive reporting functionality to automate all regulatory, investor, and internal reporting requirements.

Compliance Safeguard

Prevent malfeasance and automate required disclosures, keeping everything above board.

Custom Fields

Tailor LoanPro to your specific needs by creating an unlimited number of Custom Fields.

Role-Based Access

Ensure that team members only have access to specified features and accounts to avoid mistakes.

Reporting Suite

Comprehensive reporting functionality to automate all regulatory, investor, and internal reporting requirements.

Compliance Safeguard

Prevent malfeasance and automate required disclosures, keeping everything above board.

Custom Fields

Tailor LoanPro to your specific needs by creating an unlimited number of Custom Fields.

Role-Based Access

Ensure that team members only have access to specified features and accounts to avoid mistakes.

What our 600+ customers say about LoanPro

Chief Operating Officer

LoanPro is never our long pole. We know that we are at the stage where anything is entirely possible, and it wasn't with our previous platform.

Operations Platform Owner

With the product that the agents were using before, they had to toggle in a lot of different places to efficiently service loans. LoanPro brought that all into a single place.

Chief Operating Officer

It's good to have a strong partner that focuses on technology and building an infrastructure platform. We get more leverage out of having a partnership than building something internally.

The Modern Lending Core you need to unlock innovation

API-first platform

- Configurable, end-to-end platform

- Workflows tailored for maximum control

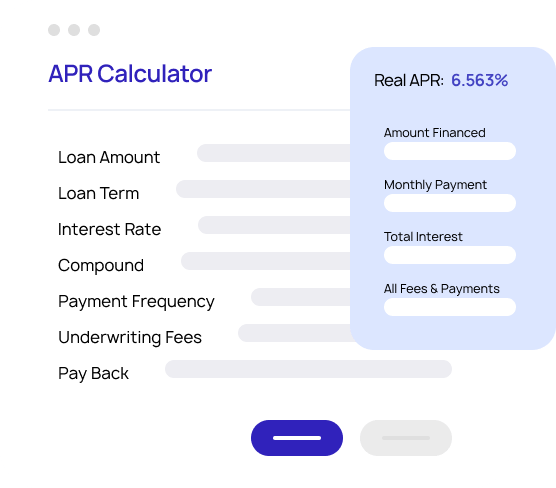

Advanced APR Calculator

- Powerful, versatile calculator built to generate precise disclosures and schedules, all while ensuring compliance

- Comprehensive Loan Recasting that empowers you to retroactively make any adjustments to any account

Ultimate flexibility and scalability

- Ultimate flexibility and scalability

- A platform that supports virtually every class of loans, lines of credit, and credit cards

- Comprehensive Loan Recasting to avoid costly errors

- The only API-first platform proven for scalability, with over 25 million loans on platform today

Additional components of LoanPro's unified credit and lending platform

Origination Suite

Ensure interest rates and disclosures are correct and use our workflows to orchestrate the highest converting path for applicants.

Servicing Suite

Unlock your lending potential by efficiently servicing any class of loans with deep, API-first configurability and robust automation.

Payments Suite

Set up AutoPay and provide maximum flexibility with any payment method supported in LoanPro.

Collections Suite

Provide payment flexibility and hardship programs for customers who are past due on payments.

Upgrade your lending core with LoanPro.

Talk with our team about the power of LoanPro’s Modern Lending Core today.