Decrease default rates with LoanPro’s Payments Suite

Unlock unlimited flexibility and configurability while maintaining PCI compliance and ensure a seamless loan repayment process with LoanPro’s Payments Suite.

Problems with traditional payment platforms

Limited payment options

Inability to accept payments multiple times per month or via one channel increases customer friction and decreases repayment rates.

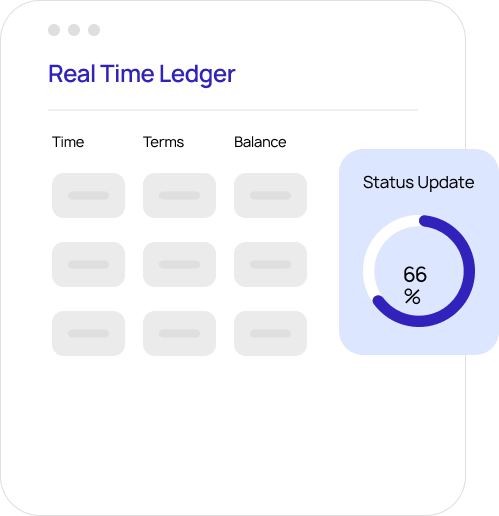

Inaccurate record keeping

When payment platforms are not integrated with the lending core, data can be lost and won’t be updated in real time.

Lack of security and compliance

Many payment platforms put the burden of security and compliance on you, increasing your regulatory risk.

Increase repayment rates with LoanPro’s Payments Suite

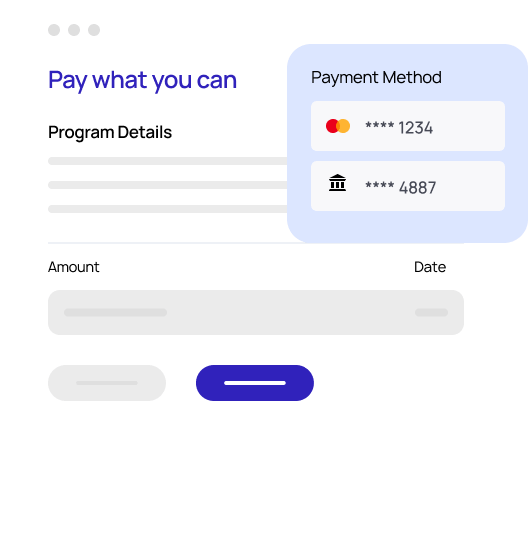

Ultimate payment flexibility

Empower your customers to pay when and how they want, with no limitations.

One platform

Payments Suite is fully integrated with our Modern Lending Core, ensuring that data is always accurate and real time.

We handle PCI Compliance

Payments Suite is completely PCI compliant, taking the burden of increased risk off your shoulders.

The value that 600+ lenders achieve through LoanPro

Increase operational efficiency

Enable borrowers to submit payments and automate NACHA Batching to remove manual effort.

Increase customer retention & loyalty

Automated payments and flexible scheduling prevent forgotten payment dates and allow you to meet borrowers where they are.

Reduce risk

Allow us to take care of PCI compliance and all payment regulations with Compliance Safeguard.

Accelerate loan growth

Accelerate loan funding timelines to increase your application pull-through rate for customers who need funds immediately.

The tools you need for dynamic payments

LoanPro’s Payments Suite provides you with all of the tools necessary to streamline loan and credit repayment and decrease default rates.

Comprehensive Payment Adjustments

Make any adjustment imaginable, from a simple date change to a complete overhaul of the amortization schedule.

Payment Application Waterfall

Easily control the distribution of each payment.

Nacha File Generation and Batching

Simplify Nacha file generation with a batching system that ensures Nacha transactions are well organized and easily tracked.

Payment Routing

Use multiple processors and intelligently route payments to the most optimal processor at that time.

PCI Compliance

Ensure that the security for your payment data maintains industry standards.

Comprehensive Payment Adjustments

Make any adjustment imaginable, from a simple date change to a complete overhaul of the amortization schedule.

Payment Application Waterfall

Easily control the distribution of each payment.

Nacha File Generation and Batching

Simplify Nacha file generation with a batching system that ensures Nacha transactions are well organized and easily tracked.

Payment Routing

Use multiple processors and intelligently route payments to the most optimal processor at that time.

PCI Compliance

Ensure that the security for your payment data maintains industry standards.

Payment Match

Select the desired payment amount and watch our robust calculator fill in the interest rate and other terms.

Payment Return Actions

Use automation to take action on a payment profile based on payment failures.

AutoPay

Agents, customers, and automations can easily create AutoPays.

Payment Profile Portability

Securely import and export payment profiles to new processors.

Payment Match

Select the desired payment amount and watch our robust calculator fill in the interest rate and other terms.

Payment Return Actions

Use automation to take action on a payment profile based on payment failures.

AutoPay

Agents, customers, and automations can easily create AutoPays.

Payment Profile Portability

Securely import and export payment profiles to new processors.

What our 600+ customers say about LoanPro

Chief Operating Officer

LoanPro is never our long pole. We know that we are at the stage where anything is entirely possible, and it wasn't with our previous platform.

Operations Platform Owner

With the product that the agents were using before, they had to toggle in a lot of different places to efficiently service loans. LoanPro brought that all into a single place.

Chief Operating Officer

It's good to have a strong partner that focuses on technology and building an infrastructure platform. We get more leverage out of having a partnership than building something internally.

The versatile lending and credit payment platform

API-first platform

- Configurable, end-to-end platform

- Unlimited options for scheduling payments and making changes

Security and compliance

- Cybersecurity that meets all requirements for PCI compliance and other payment-related regulations

- Compliance Safeguard keeps your payments aligned with changing regulations

Ultimate flexibility and scalability

- A platform that supports virtually every class of loans, lines of credit, and credit cards

- Accept all payment types with connected processors and NACHA file generation

Additional components of LoanPro's unified credit and lending platform

Origination Suite

Ensure interest rates and disclosures are correct and use our workflows to orchestrate the highest converting path for applicants.

Servicing Suite

Unlock your lending potential by efficiently servicing any class of loans with deep, API-first configurability and robust automation.

Modern Lending Core

A reliable foundation that tracks all life cycle events in our Real-Time Ledger while using Compliance Safeguard to keep you in line with updated regulations.

Collections Suite

Provide payment flexibility and hardship programs for customers who are past due on payments.

Upgrade your loan payments with LoanPro.

Talk with our team about the power of LoanPro’s flexible and configurable Payment Suite today.