End-to-end loan management system

Transform your lending programs with LoanPro’s centralized, full-suite loan management system.

A loan management system (LMS) is the central platform lenders use to manage the entire loan lifecycle, including origination, servicing, payments, and collections.

LoanPro’s API-first, full-suite LMS offers deep configurability and data visibility, helping lenders run programs efficiently and provide a better borrower experience.

Trusted by 600+ clients and partners

Managing over $22B in annual loan repayments, LoanPro's intuitive management system empowers the top lenders, fintechs, and financial institutions in the industry.

Lending just got a whole lot easier

Consolidate your existing business processes and loan servicing tasks into one, powerful loan management system. Increase operational efficiency, set yourself up to scale, simplify the loan life cycle, and create any number of loan types as unique as your borrowers.

Become an operational powerhouse

Our loan management and lending platform provides an advanced toolbox of time-saving configurations that allow you to service loans at a higher volume, in less time, with minimal mistakes.

- Manual process automation

- Built-in, step-by-step Agent Walkthroughs

- Simple but extensive loan modifications

Endless scalability

While other, out-of-the-box solutions can stifle your growth, LoanPro's loan management system is built to scale with lending businesses of any size, with architecture built to grow as you do.

- AWS Cloud Native

- Built for uncapped loan volume

- House unlimited loan programs

Where next-gen constructs become reality

Whether you're configuring a hyper-targeted loan program, or pivoting to offer next-gen constructs like buy-now-pay-later, LoanPro's loan management platform is where the rubber meets the road.

- Use preconfigured loan programs

- Build unique products with our no-code Modern Lending Core

- Access the expertise of our dedicated consultants

$22B

Annual loan repayment volume

2000+

Unique loan programs launched

92

Client Net Promoter Score

PCI, SOC, NACHA, OWASP, GDPR compliance

Delightfully integrated

Seamlessly connect LoanPro to your other systems and reap the benefits of a platform that works beautifully with your existing operation.

What our 600+ customers say about LoanPro’s Loan Management System

Gene G.

President

Great tech support and great servicing platform! The autopay feature improved our collections by over 50% and the automated payment reminders allowed us to reduce delinquencies. Our customers have the ability to make payments online and see account information, including an electronic version of their signed contract.

Tyler D.

CEO

We've been looking for a software to manage our portfolio for several years and couldn't find anything that would do what we needed and not break the bank. It is reasonably priced and is easy to use. The software is also helping manage our delinquency and collection efforts. Phenomenal product!

Alex H.

CEO

We've almost entirely automated collections. It was a struggle for us to find good collectors, and since LoanPro automatically follows up on payments, we haven't needed to staff the same workforce.

Compliance Safeguard

Is the fear of regulatory penalties slowing your scale? LoanPro's built-in compliance tools allow you to stay focused on what matters most — growing your business.

Convenience

There’s no time like your time. Ease of setup, automated workflows, and custom process guides empower your servicing team, ensuring fewer costly errors and more time on your clock.

Performance

Service more loans in less time. LoanPro is an operational efficiency powerhouse focused on making your portfolio perform. On average, our customers see a 300% uptick in overall efficiencies.

Frequently asked questions

What is a loan management system?

A loan management system (LMS) is the central platform lenders use to manage loans, including origination, servicing, payment processing, collections, and reporting. It’s the system your team relies on daily to operate efficiently and stay compliant. A modern LMS like LoanPro offers real-time visibility, automation, and flexibility, allowing you to adapt quickly as your lending programs scale.

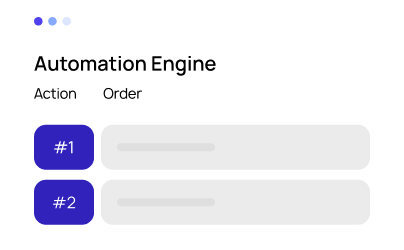

What core lending processes can I automate with LoanPro?

LoanPro’s Automation Engine allows you to automate a wide range of core lending processes, reducing human error and increasing efficiency. Key processes you can automate with our loan management system include:

- Decisioning and underwriting: Detect and prevent fraud and credit risk with native integrations to 100+ data partners, all analyzed in seconds.

- Servicing workflows: Automate loan activation, payment adjustments, due date changes, and account closures.

- Borrower communication: Send compliant, personalized disclosures, notices, and collections messages via email, SMS, or mail.

- Collections management: Automate delinquency tracking, default prevention, and collections activities based on event triggers.

Can LoanPro integrate with my existing systems?

Yes. Our loan management system is built with a flexible, API-first architecture that integrates seamlessly with your existing tech stack. We support connections to over 100 data providers for credit, fraud, and KYC, and offer native integrations with card issuers like Visa DPS, Lithic, and Galileo. Our composable platform gives you full control to build custom integrations and maintain a single source of truth for all your data.

What security and compliance standards does LoanPro meet?

LoanPro takes a "Compliance-as-a-Strategy" approach with built-in guardrails and automated workflows to support regulatory alignment. The loan management system meets leading security and compliance standards, including:

- PCI-DSS Level 1 certification for secure payment processing

- SOC 2 and SOC 3 certifications from the AICPA for data integrity and operational security

- Support for major regulations such as the CARD Act, TILA, SCRA, and PIPEDA

- Robust data protection, including encryption, role-based access controls, and continuous backups

Who else is using LoanPro’s loan management system?

Our LMS is trusted by over 600 financial organizations, from commercial to small business and consumer, including customers such as SoFi, Chime, Intuit, WaFd Bank, and Dave.com.

Start innovating with LoanPro today.

Talk with our team about driving innovation for your organization and receive access to our developer portal.