Make compliance effortless with LoanPro’s Compliance Safeguard

Stay on top of state-by-state regulations and security standards with LoanPro’s scalable, modern credit platform, built for security, compliance, and ultimate efficiency.

The most secure lending and credit platform on the market

LoanPro maintains every security and compliance certificate necessary to allow our customers to focus on growing their lending and credit portfolios.

Rest assured, you’re safe building on LoanPro as infrastructure.

Security and compliance certificates

Challenges with other platforms maintaining compliance

Data liability

Your processes require you to store borrowers’ PII and card information, making you legally liable if they’re compromised.

User errors

Critical mistakes can be made with the click of a button, leading to costly fines.

Inefficient processes

Compliance requirements change frequently, disrupting your processes and slowing down business operations.

Compliance as a matter of course with LoanPro’s Compliance Safeguard

Always up-to-date

Don’t worry about regulatory changes. LoanPro’s team of compliance experts constantly updates Compliance Safeguard to keep in line with state-by-state regulations.

Increased automation

Service your portfolio on autopilot with LoanPro’s Automation Engine, decreasing manual errors and fines.

Focus on growth

Automate compliance and regulation so you can focus on driving growth for your business.

The value that 600+ lenders achieve through LoanPro’s Compliance Safeguard

Reduce risk

Automate required disclosures, updates, and account modifications to take the burden off your agents and ensure you’re always in compliance.

Increase operational efficiency

Streamline your processes so that compliance and efficiency are the default for your agents.

Drive growth

LoanPro’s Compliance Safeguard adjusts in step with changing regulations and requirements, freeing up your time to focus on growing your business.

Increase customer retention & loyalty

Decrease the risk of backlash from lack of compliance so you maintain your positive brand image in the market.

Reduce risk

Automate required disclosures, updates, and account modifications to take the burden off your agents and ensure you’re always in compliance.

Increase operational efficiency

Streamline your processes so that compliance and efficiency are the default for your agents.

Drive growth

LoanPro’s Compliance Safeguard adjusts in step with changing regulations and requirements, freeing up your time to focus on growing your business.

Increase customer retention & loyalty

Decrease the risk of backlash from lack of compliance so you maintain your positive brand image in the market.

Compliance Safeguard — the solution you need to easily maintain compliance

LoanPro’s Compliance Safeguard provides you with all of the tools necessary to streamline your compliance processes.

Audit Trail

Seamlessly track all action taken in the system for auditing and error resolution.

Role-Based Access

Control who has access to sensitive information and what they can do with it.

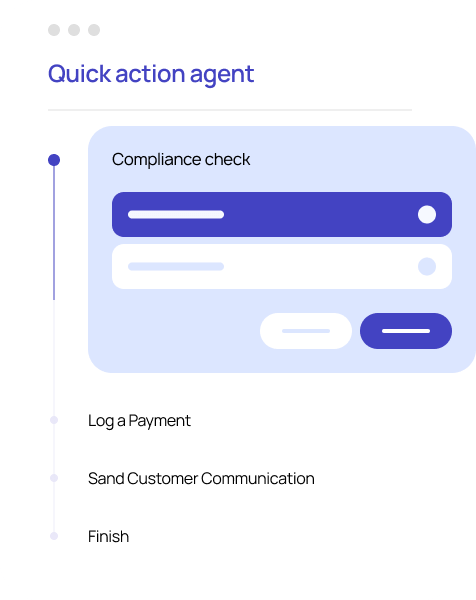

Agent Walkthroughs

Agents are guided through each step of your processes, preventing non-compliant deviations.

Comprehensive Loan Recasting

When SCRA requirements come knocking, meet them with confidence and easily recast your loans.

Audit Trail

Seamlessly track all action taken in the system for auditing and error resolution.

Role-Based Access

Control who has access to sensitive information and what they can do with it.

Agent Walkthroughs

Agents are guided through each step of your processes, preventing non-compliant deviations.

Comprehensive Loan Recasting

When SCRA requirements come knocking, meet them with confidence and easily recast your loans.

Loan Document Management

Keep track of all loan documents — including consent forms and waivers.

APR Match

Ensure the APRs for your loans meet required parameters.

Communications Suite

Automatically generate and send dynamic notices and disclosures.

PCI Compliance

Ensure that the security for your payment data maintains industry standards.

Loan Document Management

Keep track of all loan documents — including consent forms and waivers.

APR Match

Ensure the APRs for your loans meet required parameters.

Communications Suite

Automatically generate and send dynamic notices and disclosures.

PCI Compliance

Ensure that the security for your payment data maintains industry standards.

The versatile platform for compliance

Security and compliance

- Cybersecurity that meets all requirements for PCI-DSS, Safeguards Rule compliance, and more

- Compliance Safeguard to keep your payments aligned with regulations

Unlimited flexibility and scalability

- A platform that helps maintain compliance for virtually every state-by-state regulation

- Keep up with changes to regulatory requirements, no matter how big or small

Enhance your organization’s compliance with each component of LoanPro’s scalable credit and lending platform

Modern Lending Core

Stay in line with updated regulations with Compliance Safeguard, while the system automatically tracks all activity in our Real-Time Ledger.

Origination Suite

Ensure interest rates and disclosures are correct and use our workflows to orchestrate the highest converting path for applicants.

Servicing Suite

Unlock your lending potential by efficiently servicing any class of loans with deep, API-first configurability and robust automation.

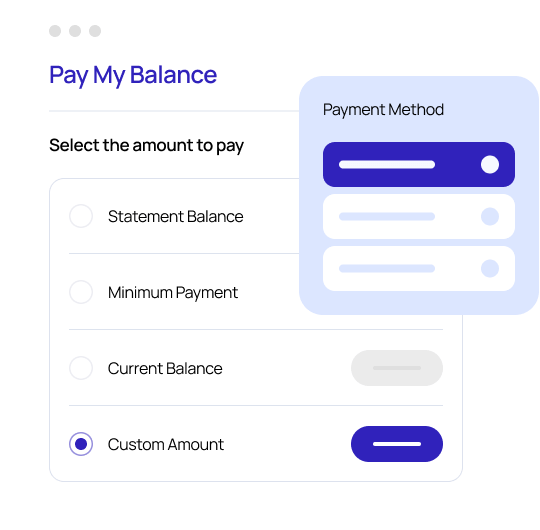

Payments Suite

Set up AutoPay and provide maximum flexibility with any payment method supported in LoanPro.

Collections Suite

Provide payment flexibility and hardship programs for customers who are past due on payments.

Upgrade your compliance with LoanPro's Compliance Safeguard.

Talk with our team about your organization's lending and credit operations today.