Why Data Visibility Matters

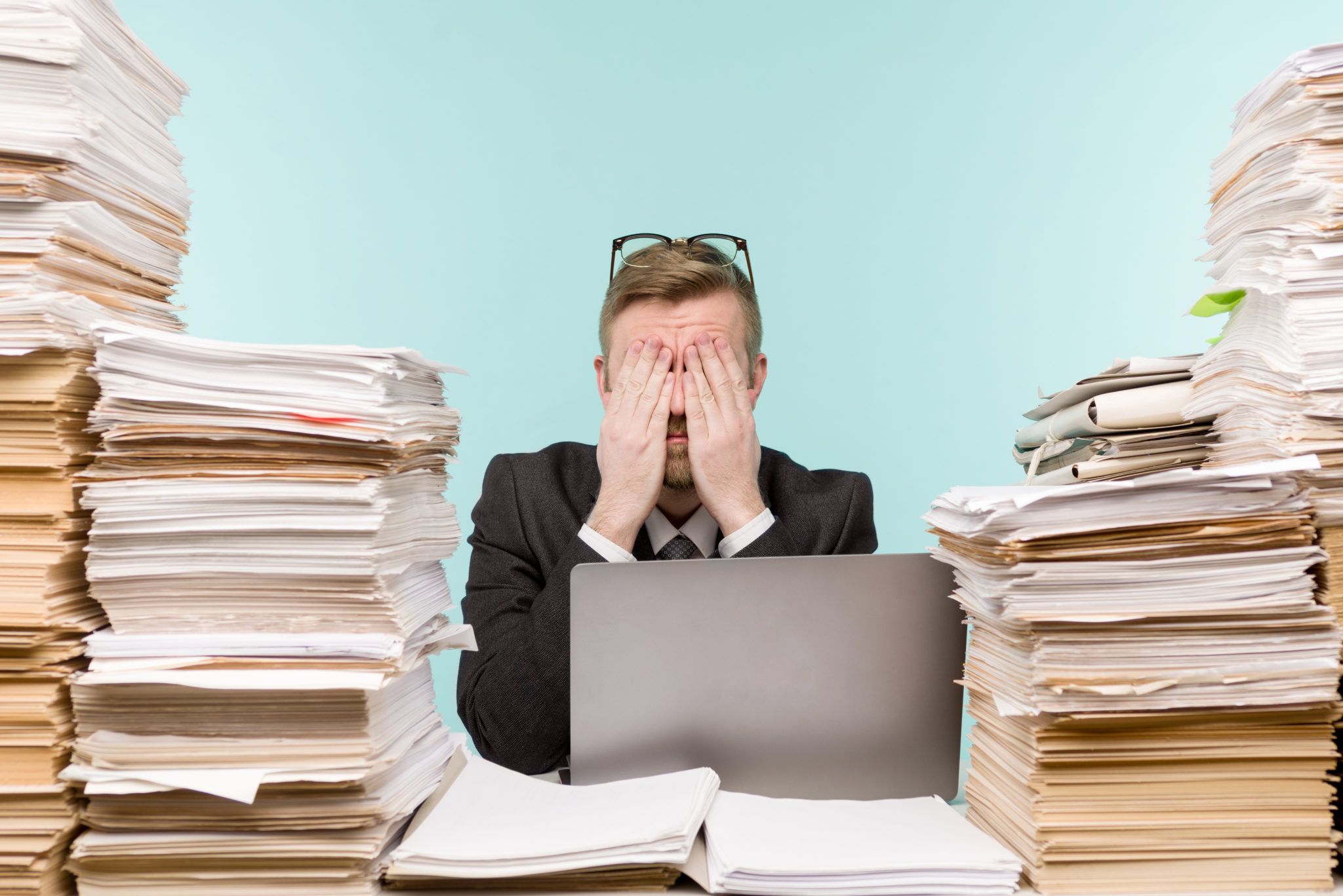

You might struggle with poor data visibility if your lending business relies on several departments to accumulate data. That’s because sensitive data stored in different platforms and kept in silos makes it difficult to access, manage, and protect.

When information is spread across multiple systems or departments, managing sensitive data becomes chaotic — which is the last thing you want when working with valuable customers. This is called “poor data visibility,” and it leaves lending businesses at a disadvantage and prone to privacy risks.

That’s why data visibility should be a priority for any lending business with a lack of data management and security measures. Not only does proper visibility drive informed decision-making, but it also streamlines data management and how you capture data. In this article, we’ll look at data visibility, what lending businesses can gain with easily accessible data, and how to start the process of improving your own visibility.

Let’s Talk About Data Visibility

Data visibility is when a business understands the data in its systems and where they are located. Having insight into this information also allows leveraging that data to make informed business decisions.

For example, many lending organizations hold crucial information that they use daily, such as:

- Project managers use data to deliver results

- Operational staff use it for capacity planning

- Analytics departments leverage data to understand performance

- Information security professionals use it to create policies that reduce the risk of data loss

But ensuring success is impossible when no one knows what data they have and where the valuable information resides. So, how does a lending business keep a healthy pulse on the data stored?

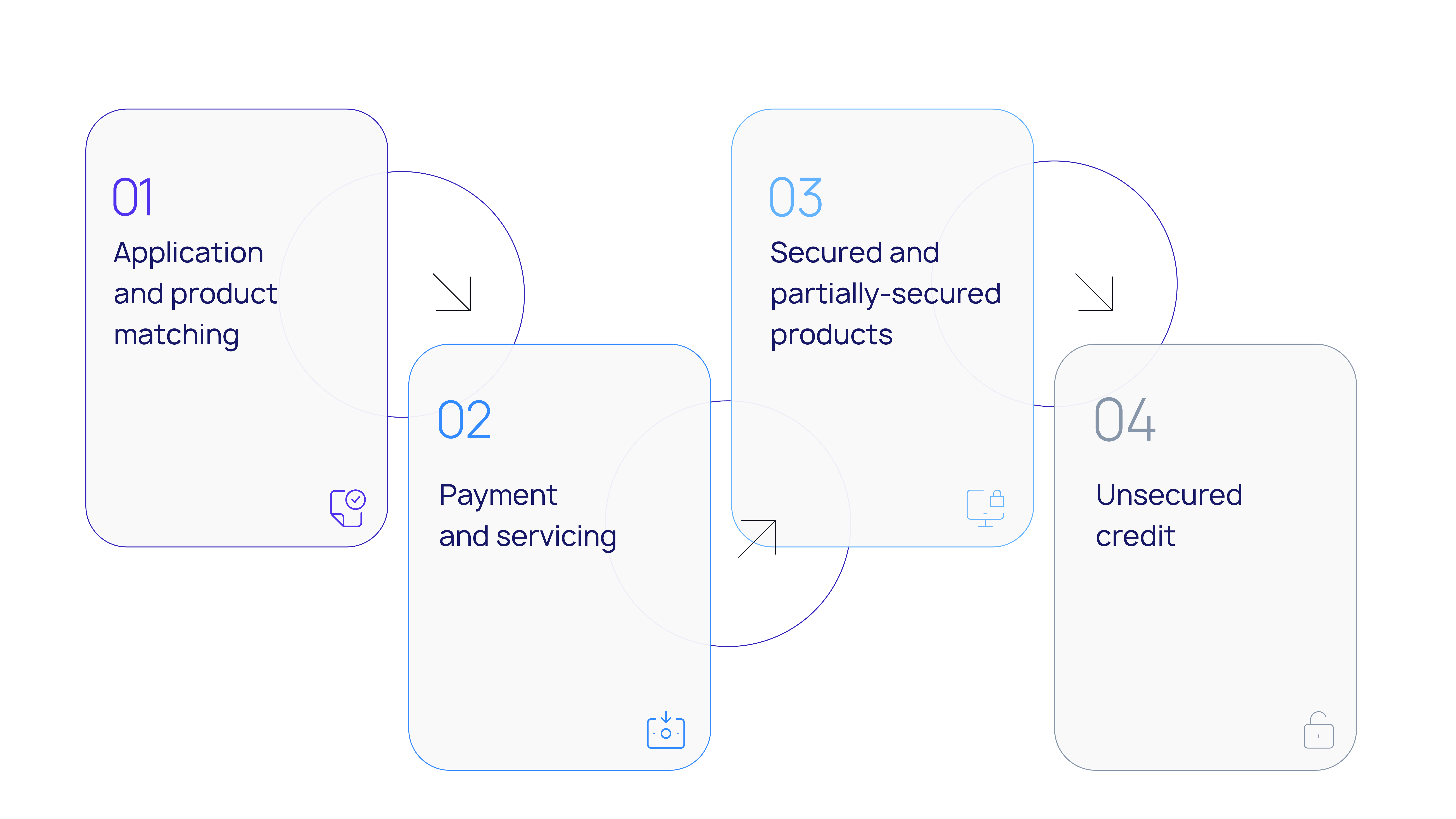

First, it needs to be clear where all the data is coming from. That means there should be data intake processes, such as different forms to fill out for varying loan products, the types of documents that applicants hand in, and how employees deliver their personal data.

Second, a lending organization must understand where the data is stored. For example, where does the information go once an applicant fills out their loan application, and where are their supporting documents stored?

Organizations with centralized data repositories store all their data in one place, which makes data management easier.

Others might have more scattered data storage. For instance, some employees store data in a central repository, while others might save it in their local drives or create their own folder structures. This makes it impossible to see where the data is and analyze it to gain insights.

To improve data visibility and streamline data management, organizations need the right technology, the right processes, and the right people because:

- The technology acts as a place to find displaying data across the enterprise.

- The processes exist to make sure that the data is stored in the right place.

- The people are trained to follow the processes, so the organization can reduce risk and avoid a data breach.

And with so much data out there — in servers and the cloud — having the right data visibility programs is a key to organizational success.

Top 6 Reasons Why Good Data Visibility Is Important

With pressure to provide a better customer experience, protect sensitive data, comply with privacy laws, and deliver products and services, data visibility is more critical today in loan management than ever. Here are six reasons why your business should ensure data visibility.

Reason #1: Reduce Security and Compliance Risks

Regulatory bodies have passed new laws to protect consumer privacy and increase data security in recent years.

For the financial industry, organizations must comply with PSD2, PCI-DSS, Gramm-Leach-Bliley Act, and the NYDFS Cybersecurity Regulation if they deal with sensitive data (such as names, phone numbers, social security numbers, and bank information).

But if these organizations don’t take the necessary measures to combat their poor data visibility, they could also become the victim of a hacking or phishing attack. Then they could lose customer data — along with customer trust.

Data visibility is a great solution to enhancing security in any lender organization. When organizations understand their data type and where it’s stored, their information security team can apply the proper security and access policies.

As a result, the organization complies with privacy regulations and is better protected against data loss.

Reason #2: Ensure Efficiency

When loan officers track down a customer’s correct data, they may make mistakes using out-of-date information. If the lender doesn’t have a centralized loan management system, there’s a bigger risk of inefficiency and inaccuracy when processing the application.

Lender employees also won’t be able to identify each application or find the supporting documents with ease. Instead, they’ll have to spend time locating the data across different repositories.

Data visibility processes and solutions help make your organization more efficient. With it, you can engage in the right capacity planning for each department. You can also increase productivity because employees have the right processes and tools to find the necessary data.

Reason #3: Increase Strategic Decision-Making

Organizations with data visibility have access to valuable insights that give them a competitive advantage and help them make smarter business decisions and improve the customer experience.

When data is in a central repository, it can act as a single source of truth. Analyzing that data allows organizations to uncover critical business efficiency and customer-related pain points.

For example, data in a central loan management system can show customers’ most preferred types of loans, helping lenders create tailored offerings and boost profitability.

Once organizations identify pain points, they can take the necessary steps to engage in strategic decision-making rooted in data. The business avoids decisions based on the reasoning that “we’ve always done it this way” and instead relies on clear insights to drive decisions.

Reason #4: Improve the Customer Experience

A better understanding of your organization’s metrics means you can analyze data and identify areas worth improving, ultimately delivering a better customer experience.

With more data visibility, you’ll always have the information you need to meet evolving customer expectations. Your organization will be able to consider the following:

- Security gaps could be putting your business at risk of losing customer data. You can then implement more secure access management protocols, giving your customers more confidence in your processes.

- Process gaps stop you from delivering a better experience, including loan applications, loan processing, risk analysis, and monitoring. When you understand these gaps, you can fix them.

- Where customer communications aren’t fluid. With this information, your teams can automate the customer’s experience and improve satisfaction.

Improving customer experience pays off in retaining current customers and attracting new ones. In fact, Zendesk reports that 75% of people are willing to pay more to do business with providers that offer better customer experience.

And data visibility can help you map every customer touchpoint, view processes and performances, and gather ideas for improving each process.

Reason #5: Drive Business Profitability

The deepest data visibility can also help you monitor and predict business growth. By displaying available data and understanding growth rates, you can forecast growth trajectories and develop ideas for creating solutions that make that trajectory more positive.

Coupling growth predictions with strategic decision-making based on data can drive success.

The numbers support this: A study by the University of Texas found that increasing data visibility and usability by just 10% can significantly impact profitability. For an average Fortune 1000 company, the increase can be as much as $2 billion a year.

Reason #6: Enhance Communication

By embracing a data-driven decision-making approach, you can also foster a company culture that’s more transparent and helps all your teams stay on the same page.

People know what information is used to make decisions, better understand the ‘why’ behind process changes, and know who to communicate with when they have an idea, question, or concern.

Also, with accurate reports, visualizations, and a data-driven sales strategy, you can better equip your organization and empower the people within the company to succeed and reach goals.

Key Steps to Take to Use Data to Your Advantage

There’s good visibility, and there’s poor visibility. Good data visibility tells you where data is coming from and where it’s stored, but there are two significant signs that your visibility may need improvement:

- Data across the organization is managed and accessed by different people

- Attempting data access within your system is often time-consuming and challenging to narrow down

If this sounds familiar, then you need to improve your data visibility. This requires a holistic approach that spans the entire business and necessitates the collaboration of the C-suite and management. Here are three ways your lending business can improve data access and visibility.

Step #1: Clean & Organize Your Data

Your data is spread across different systems, so purchasing software or implementing new processes can’t work before you actually clean and organize it. Every department must go through a data cleaning exercise, so you can gather similar data into one place and get rid of stored data that you don’t need.

Retaining and organizing high-quality data means that you will get high-quality insights. In data science, this is called GIGO and stands for Garbage In, Garbage Out. If you base your decisions on bad data, you will have bad insights. So the first step is to ensure that you remove the garbage data.

You can then easily implement a piece of software, such as a loan management solution, and leverage it to store future data.

Step #2: Eliminate Cognitive Biases

Every organization can fall into the trap of thinking that the way they do things is the right way. For your lending business to experience the full benefits of data visibility, you need to have the mindset that there is always a better and more efficient process out there, and data can help you unlock it.

Engage in various workshops and exercises that instill a sense of innovation within your team. The goal is to encourage people to stop making decisions based on past projects that have worked or drawing from limited or outdated information.

Instead, create a culture that values and uses business analytics to create a competitive advantage and deliver superior results.

Step #3: Test Data-Rooted Decisions

Once your organization has data visibility and starts making data-driven decisions, you still have to continue questioning those decisions. The process of extracting insights from data stored in your organization is continuous, and you should test and refine the insights and decisions you make.

If, for example, the data points toward creating a new loan offering, you can test that with customers and see if it’s successful. If not, you can continue to analyze the data and see what else you can come up with.

Basically, you should use the data as a tool to inform you, not to think for you. It’s always important to test your insights against real-world scenarios and continue to draw upon new data to refine your decisions.

Conclusion

Lending organizations deal with a lot of sensitive information — but when it’s spread out and stored across systems, you could run into security compliance and efficiency problems. Additionally, siloed data can make it difficult to analyze information and make smarter business decisions.

That’s why implementing data visibility best practices can lead to improved profitability, innovation, enhanced security, and more. But having access to all the data in your organization and gaining complete data visibility is a continuous process that requires alignment with people, processes, and technology.

That’s where LoanPro comes in. While your organization can invest in people and processes, LoanPro can take care of the technology.

LoanPro is a core lending software powering financial innovation through automation and data visibility. Our company specializes in loan servicing, and our system supports every step in the loan lifecycle.

Today, we support more than 800 lenders who have experienced a 300% increase in efficiency — and you can join them. Start your journey toward complete data visibility and reap the benefits of our modern loan management system.