What is CECL?

The 2008 financial crisis left the U.S. economy in shambles, and some of the biggest losers were lending departments. As a response to the crisis, the Federal Reserve cut interest rates to try and stimulate recovery, but this didn’t spur lending or economic activity as hoped.

Bank lending finally started growing again in 2011 but at a much slower pace than in the early 2000s. Total loans in the U.S. banking system peaked at $8 trillion in 2008 before the market crashed. Loans didn’t reach this figure again until 2014.

The financial crisis brought into question how future-proof financial institutions truly were. The lesson learned was that present security doesn’t equal future stability. In other words, without the right corrective actions, another financial crisis could wipe out lending businesses and departments once more.

Companies in the financial industry need to understand risk better so they can safeguard their business against uncertainty. To encourage more risk-averse decision-making, Congress enacted regulations that impact the financial industry.

One of them is CECL (current expected credit loss). This article tackles what CECL is and why it matters to your financial organization.

CECL in a Nutshell

What is CECL? It’s a new accounting standard that requires financial institutions to record “life of loan” loss estimates at loan origination or purchase. Essentially, CECL mandates organizations to calculate bad debt using a predictive and forward-looking model instead of the current incurred loss (ICL) accounting method.

The Financial Accounting Standards Board (FASB) published its Accounting Standards Update (ASU) No. 2016-13, Financial Instruments – Credit Losses (ASC Topic 326 or ASC 236) in June 2016. It replaced FAS-5 and FAS-114, the previous standards used to account for credit losses.

The update introduced current expected credit loss standards, explaining how banks and other financial organizations should estimate allowances for loan and lease losses (ALLL) using forward-looking data rather than just historical data.

To do this, you need to estimate credit losses over the entire “contractual term,” from origination right through to servicing.

Why Is CECL Important?

The idea behind CECL is to encourage banks and online lenders to account for unforeseen economic changes that could affect risk calculations on financial assets.

Before CECL, banks looked at past credit losses to predict future losses. But the recession revealed how ineffective this method is because it doesn’t consider credit losses beyond an individual company’s control, such as those triggered by a global economic crisis.

With CECL, companies need to:

- Group assets according to risk profile, rather than type for proper segmentation and analysis.

- Implement a system of constant financial reporting of losses so third-party partners, such as auditors, can stress test a company’s accounting.

It is a departure from the U.S.’s legacy Generally Accepted Accounting Principles (GAAP), which lacks forward-looking economic forecasts that empower banks to make necessary adjustments to prepare for the future. The old methodology also delays the recognition of credit losses due to the use of incurred loss.

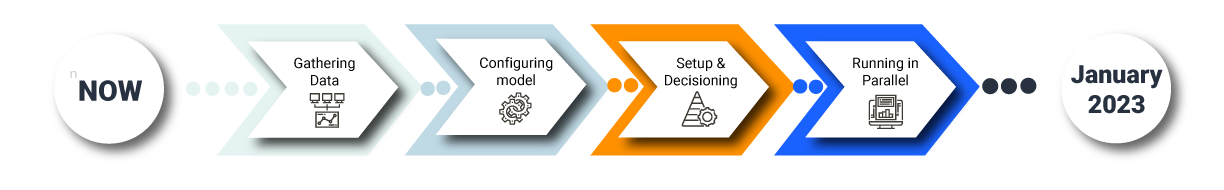

And it’s not just for large banks — all companies complying with GAAP must adopt CECL. The initial deadline for CECL implementation was on December 31, 2020. But the FASB moved it to January 2023 for both smaller reporting companies and nonpublic companies.

Federal regulators recommend that all financial institutions start looking into CECL as early as possible.

Since the methodology uses a much deeper and more complex loss modeling and analysis system, organizations are expected to build their platforms for managing financial risk factors sooner than later. Your first step is to understand CECL methodologies and what you can do to prepare.

Methods to Compute CECL

FASB’s CECL update doesn’t suggest a specific method for financial institutions to estimate current expected credit losses. However, it does provide guidance on what you should consider when estimating credit losses.

It will be up to you to decide what method to use for computing your CECL. Below are four accounting methods you can use to learn about expected credit losses.

- Aging Schedule — This methodology is used to forecast the allowance for delinquent debt on trade receivables or the money customers owe to a business after a successful sale on credit. You can calculate the historical loss rates by determining how long a receivable is past its due date (also known as the age category). The greater the age category of a receivable, the more significant the rate becomes.

- Discounted Cash Flow — To compute discounted cash flow, you need your future cash flow’s estimated figure based on its current value and discounted at the loan’s effective interest rate. By subtracting this figure with the amortized cost basis, you will be able to determine the allowance for credit losses.

- Loss-Rate — After segmenting financial assets according to risk profile, you can determine each segment’s historical rate of loss using past data. Adjust estimated credit losses to reflect the current and future expectations. Finally, multiply the adjusted loss rate and the amortized asset cost to get the credit losses.

- Probability of Default Methodology — You’ll need three specific values to use this methodology: when a loan defaults, the probability of default, and the loss given default, which refers to an incurred loss for every default. Multiply all these values to compute for the expected credit losses of your assets.

- Roll-Rate — Also known as “migration analysis,” roll rates are similar to loss-rate in that you must segment your assets first according to delinquency. From here, determine the roll rate by figuring out the percentage of account balances moving from succeeding to delinquency stages.

All of these accounting methods offer insight into the potential for future losses. Choose the one that suits your organization best. If you have more than one loan type in your portfolio, you might decide to use more than one CECL methodology.

How to Prepare Your Organization for CECL

While your organization still has months before the CECL regulation takes effect, you should put the pieces in place as soon as possible. This way, you can seamlessly implement the policies of this methodology once it becomes a requirement.

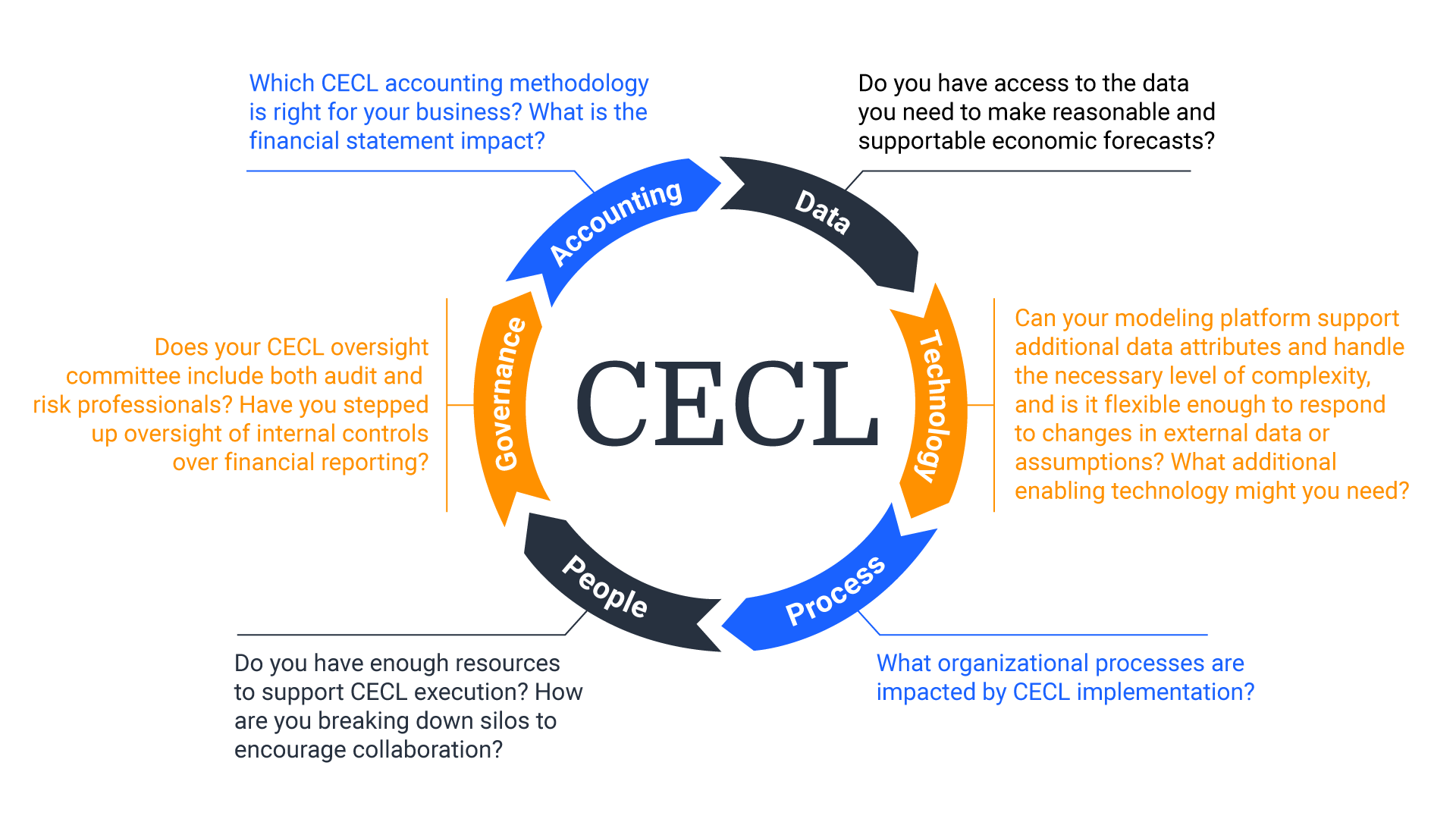

Because CECL requires an in-depth process to produce predictive analysis of your portfolio’s credit expected losses, you must prepare for an organization-wide change.

Ensuring you have enough resources in place to execute CECL, knowing which accounting methodology is right for your business, and making sure your technology gives you access to necessary data are all steps you need to take in the months leading up to CECL.

Identifying challenges and solutions ahead of the deadline allows you to resolve data gaps and accuracy issues in your initial implementation. You can also test different methodologies to see which one works the best.

Here are some of the steps you can take now to get ready for CECL implementation:

Collect Data Now

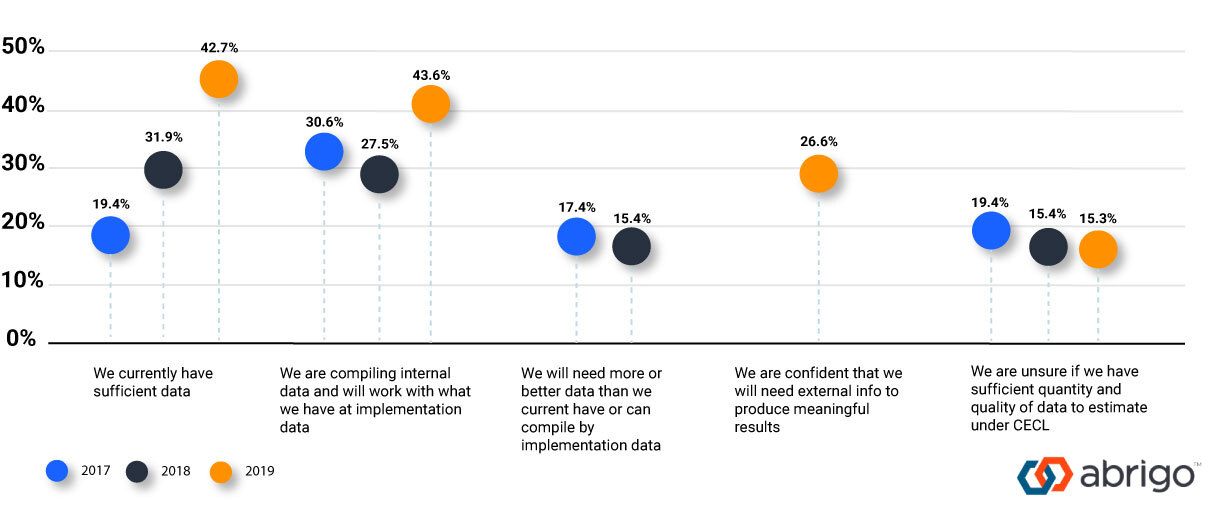

You need a system to store current and historical data, which you’ll need to implement your forecasts and model the loan credit cycle. Regarding historical data, go back as far as ten years or check your loan’s time-series view to get a clear picture of its life-of-loan performance.

Also, having historical loss rates on hand is not enough—you’ll also need data about your good loans to assemble a forward-looking model.

The 2019 Abrigo Lender Survey shows that 42.7% of lenders claim to have collected sufficient data in preparation for CECL, which is an increase from the previous years (19.4% for 2017 and 31.9% for 2018). However, only 26.6% are confident that their data will help them meet CECL policies.

If your internal historical data is insufficient, you may need to look for external data sources such as Federal Reserve Economic Data (FRED), which you can use as reference points to help make sense of your information.

Take a Cue from Early Adopters

Research financial institutions similar to yours that have already implemented CECL. This will help you determine what results you should expect, whether you’re a credit union, online bank, or another lender.

For instance, an S&P Global study revealed that U.S. banks with over $10 billion in total assets experienced an increase in their year-over-year provisions for loan losses after adopting CECL.

Monitor their progress and learn from their experiences. This can help you apply CECL requirements in your organization by doing the right things and avoiding the mistakes early adopters have made.

Validate the Model You Will Use

Once you’ve decided which CECL methodology to use after rigorous testing, observe the best risk management practices for your chosen model.

To get started with this, develop a control structure for validating inputs and outputs in your calculation. This allows you to sustain the accuracy of the results acquired from the methodology.

The goal is to have a streamlined process powered by clean data so you clearly understand the potential financial risks your company could face.

Conclusion

The CECL accounting standard will take full effect soon. And as a business entity that complies with the GAAP, you must adopt CECL before 2023.

Ideally, you’ve already started your CECL implementation journey, or you have plans to begin right away. Starting now will give you time to work out any kinks and accurately forecast your credit losses.

Success with CECL starts with proper data collection. Once you have gathered current and historical data, you can decide which methodology to choose. You can also gain insight by looking at the experiences of early adopters.

If you have loan servicing data that you want to organize and track properly, you’ll need software to get the job done. LoanPro is a platform that helps manage the loan process via automated payoffs, collections, lifecycle monitoring, and more. From here, LoanPro can track everything happening in the loan servicing stage, which you can use to help build your CECL database. Schedule a demo today to see LoanPro in action.