VPC Q4 2024 release notes

O V E R V I E W

Welcome to the latest release notes for LoanPro’s modern lending and credit platform. These notes summarize our most recent releases, organized into sections for important reminders, new features, general platform updates, and changes related to specific credit product types. We update and distribute these notes quarterly so you stay informed about the latest developments and improvements to our platform. For more information, visit our knowledge base.

R E L E A S E S

New features

- UCC lien search and filing. If you secure your accounts with collateral, liens let you publicly document that legal claim to the asset. Our lien filing tool makes it easy to file liens on borrower collateral. And, if another lender already has a lien on the asset, our lien search tool helps prevent credit risk by checking public records for existing private and tax liens.

- Nacha "On Us". The new Nacha “On Us” feature simplifies payment processing for financial institutions. It identifies payments associated with specific routing numbers and keeps them in-house, avoiding unnecessary ACH network fees. Previously, lenders had to manually scrub files for internal transactions or send all payments through the network. Now, with this feature enabled, transactions are automatically separated into two distinct files: one for internal processing and another for network submissions. Nacha “On Us” can be enabled in Secure Payments by navigating to Processor > Bank Account/ACH > Nacha Batch Submission then editing or creating a new processor. Once enabled, it will prompt you to enter routing numbers for internal transactions and select an export type. The next batch will generate two separate Nacha files, including one labeled “On Us”.

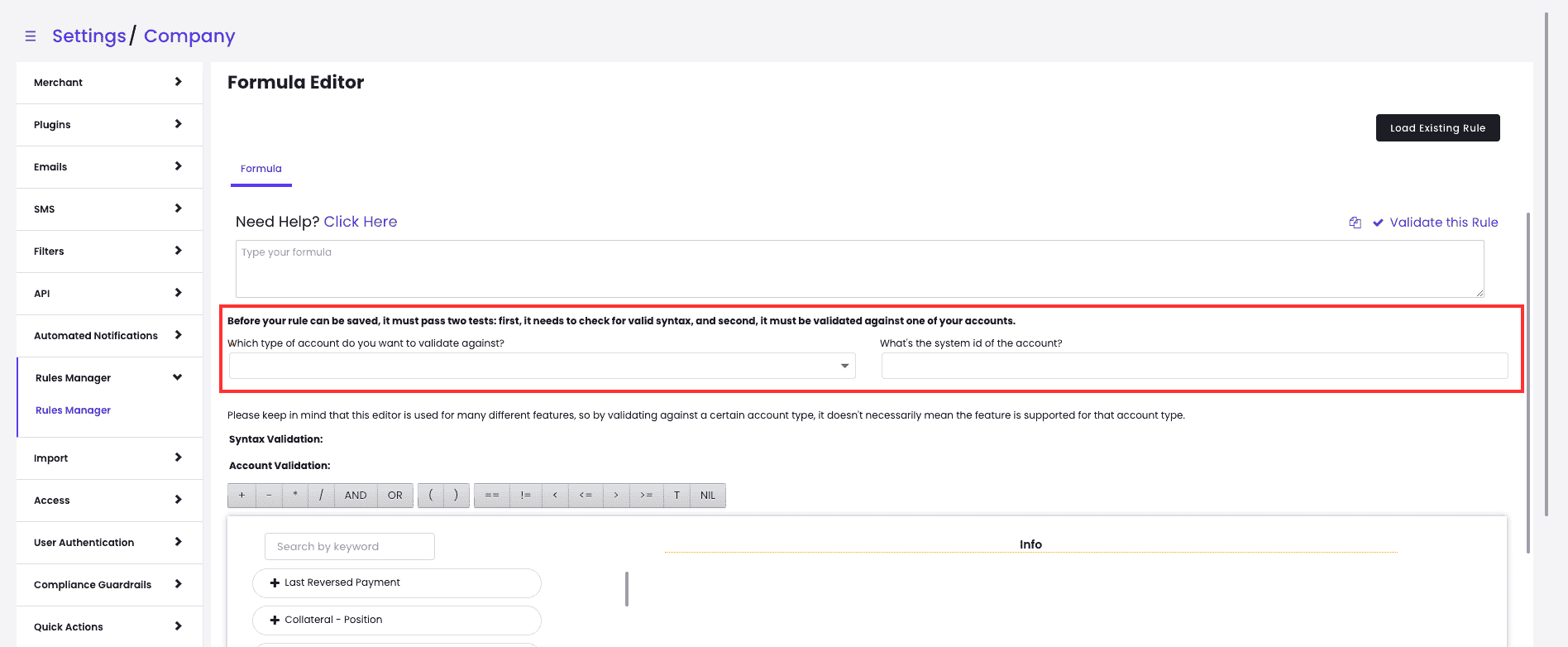

- Rule formula editor updates. We’ve added two new features to make working in the rule formula editor easier. You can access the editor from several different pages in LMS—like the Rules Manager and Automation Engine.

- Rule copy button. The new copy button ensures you capture the entire rule without missing characters, preventing errors when promoting rules from your sandbox to production tenants.

- Rule validation. You can now test rules directly in the editor by entering a loan or line of credit ID. The system runs the rule against the account to check if it meets the criteria, returning a ‘true,’ ‘false,’ number, or string. This makes it easier to verify that your rules work as intended.

- Auto insurance verification. LoanPro now makes it easier for auto lenders to confirm borrower insurance coverage on loan collateral. When a borrower submits proof of insurance, LoanPro compares the provided information with the insurance company’s records to verify the collateral is insured. This update reduces manual errors and helps ensure compliance.

Screenshot of LMS formula editor

General Updates

- New Report File Hub for streamlined reporting: LoanPro’s new Report File Hub simplifies how you access your data for reporting. Previously, clients had to manage their own secure storage (e.g., SFTP, Google Drive), which for some was technically challenging and costly. With the Report File Hub, you can now access, upload, and manage reports directly within the LMS, with added permissions to control access. The hub supports 35 file types, offers custom naming, tagging, and search features, making it easier to find, import, and manage reports efficiently. You can access it by navigating to Reports > Administration > Report File Hub.

- CPA-005 file update: We made updates to the CPA-005 file to align with TD Bank specific requirements for our Canadian lenders. This new version is tailored exclusively for TD Bank and may not be compatible with other Canadian banks.

- Account display ID update: Loan and line of credit account display IDs now appear in browser tab descriptions, allowing servicing teams to easily identify accounts without clicking into each tab. Previously, all tabs were labeled “LoanPro,” making it difficult to distinguish between tabs. This update makes it simpler to work across tabs and improves efficiency.

- Customer portal updates

- Multi-factor authentication (MFA) added. We now offer multi-factor authentication (MFA) for the customer portal through an authenticator app, SMS, or both. MFA is optional, so if you’d like to set it up, just reach out to your LoanPro contact.

- New default domain. We’ve updated the customer portal’s default domain to http://webaccessportal.com/. This replaces the previous domain of onlineaccess.io. Clients without a designated domain will be transitioned to the new default.

- Skip tracing integration performance update. We’ve improved the way borrower data is retrieved in our skip tracing idiCORE integration. Previously, the system looped through data objects individually, making separate requests for each item, which could slow down processing. Now all data objects are requested at the same time, improving efficiency and ensuring you have faster access to the data you need.

- Improved SMS inbound messaging. Our Interactive SMS solution now supports replying to all inbound messages. Previously, auto-replies were limited to compliance-required keywords like HELP, STOP, and START. Now, when a borrower sends a question or other random message, they’ll receive a generic confirmation acknowledging receipt.

- Default payment profiles for logging payments. We’ve added a default payment profile option to our default settings. Now, default payment profiles can be configured for all loans, improving the experience when logging payments. This also ensures payments are not processed without an assigned payment profile. To set a payment profile default navigate to Settings > Defaults > New Transaction > New Payment > Edit > Default Payment Method.

- Dynamic refersh for collector queues. Collector queue now supports both adding and removing accounts based on your custom filters. Previously, the collector queue was only able to dynamically remove accounts.

- Bug fixes

- We fixed an issue where documents were repeatedly uploaded and stored within a loan account via the Recovery Database Network (RDN) integration, causing duplicates. Now, documents uploaded via RDN are uploaded to accounts only once.

- We fixed an issue that was causing the value of the linked accounts effective balance in the line of credit daily archive to display as zero. Now, this value is calculated and displayed correctly.

- We fixed an issue that was causing bank account verification errors for those using the ValidiFi integration. Previously, a character limit constraint imposed on bank account numbers was leading to errors during verification. This constraint has been updated, ensuring bank accounts of all lengths are verified by ValidiFi properly.

Installment Loan

- Cross-tenant account transfer tool: Cross-tenant account transfer tool transfers data from one tenant to another, making it especially useful for clients with more than one production tenant. Previously, accounts needed to be moved manually, which was time consuming and tedious. Now, you can specify the loan information you’d like to transfer and establish rules to automatically move that information to another tenant.

- Enhanced Funding event-based notification: You can now trigger notifications, like webhooks or emails, when Enhanced Funding transactions are posted on a loan account. Previously, no option to trigger notifications for enhancing funding events.

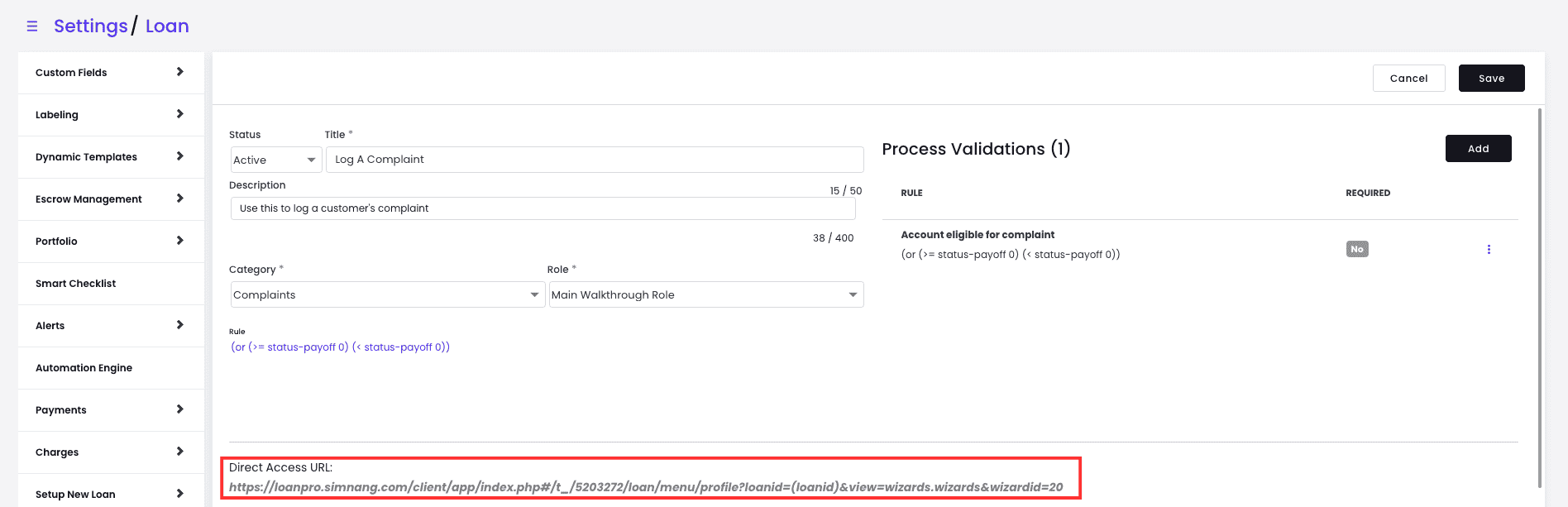

- Agent Walkthrough direct access URLs. Agents can now jump straight into specific walkthroughs using direct access URLs, removing the need to navigate to the Agent Walkthroughs page of a loan account. These links cut down on clicks and include an optional "skipAlert" parameter to bypass rule validation. You’ll find these links when editing or creating an Agent Walkthrough.

- Loan participation management. We’ve added a new loan participation feature to make it easier to manage loans shared between multiple investors or participants. This feature lets you create child loans linked to a parent loan, automatically distributing ownership based on investor percentages. The process is automated through a rule you set and can also update repayment schedules, link customers, and post a summary note to the parent loan. For more information, read our knowledge base article.

- Contract proceeds automation. We’ve introduced a new contract proceeds integration to automate the transfer of data between a new loan and its corresponding existing loans. This feature updates the old loan’s fields with new loan data and changes its status to ‘Contract Proceeds,’ making it easy to track and manage. What used to require manual data entry is now fully automated, reducing the risk of errors and inconsistency across accounts. For more information, read our knowledge base article.

- Expanded document upload integration with Recovery Database Network (RDN). Our integration now supports uploading all documents, including files, images, and other formats, from RDN to LoanPro. To prevent duplicates, only newly uploaded documents are sent to LoanPro. This resolves an issue where documents were repeatedly uploaded, causing duplicates.

Screenshot of LMS formula editor

Line of Credit/Credit Card

- New AutoPay feature for linked accounts: We’ve expanded AutoPay functionality for line of credit accounts. You can now set an AutoPay amount that covers the total balances across all linked accounts, whether as a one-time or recurring payment. When combined with our Split Payment feature, AutoPay on a parent line of credit account will automatically allocate funds to cover the balances of each linked account, streamlining payment management across accounts.

- Line of credit AutoPay totals. We’ve added a new ‘Current Due Amount’ option for AutoPay on line of credit accounts. This option aggregates amounts due from all linked loans and the minimum payment amounts from all linked lines of credit into a single AutoPay. This update helps to streamline payments, reduce the risk of missed or partial payments, and generally makes life easier for both you and your customers.

- Line of credit AutoPay renewal automation. We’ve updated the renewal process for line of credit accounts. Now, when you renew an AutoPay, its status automatically changes from ‘Failed’ to ‘Pending,’ and it’s queued for reprocessing—no manual steps required.