VPC Q3 2024 release notes

Welcome to the release notes for LoanPro’s modern lending and credit platform. These notes cover the past quarter’s VPC releases, organized into sections for new features and general platform improvements. Whether it’s a refreshed look for LMS, smarter checklist management, or faster payment processing, this release is focused on making your workflows smoother and more efficient.

Here’s what’s new:

- A fresh, modern look for LMS

- Faster payment processing with Nacha file V2

- Simplified loan adjustments using the Simple Roll Schedule tool’s new overwrite option

- Streamlined workflows with improved Smart Checklists

We publish these notes quarterly to keep you informed about the latest developments. For the full details on release, visit our release notes page in the knowledge base.

R E L E A S E S

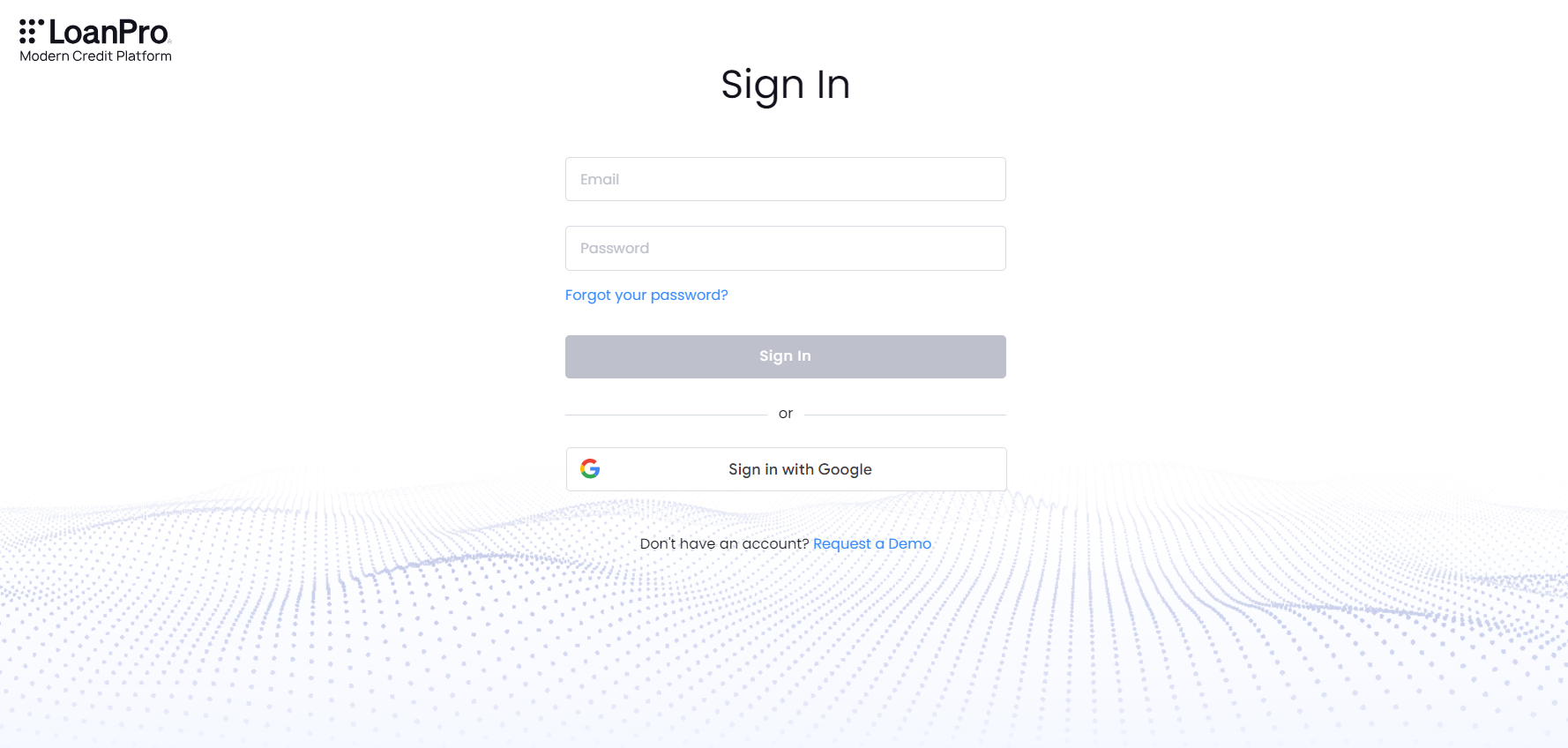

LMS brand refresh

We’re rolling out a refreshed look to LoanPro’s LMS, including a modernized login page, an updated color profile, and a new, easy-to-read font to improve your overall experience.

Screenshot of the new LoanPro LMS login screen

New Nacha file V2 in Secure Payments

Nacha file V2 is now available in Secure Payments, bringing several key improvements:

- No transaction cap: A single file can now handle more than 50,000 transactions, eliminating the previous limit.

- Faster processing: The time it takes to process and batch transactions (time-to-batch) has been reduced by 98% compared to the previous version and now scales more consistently as transaction volume grows.

In this new version, batch numbers and the Transaction Unique Counter now start at 1 instead of 0. While file V1 is still supported, we recommend migrating to V2 now to take advantage of these improvements.

Simple Roll Schedule tool enhancement

We’ve made it easier to adjust borrower amortization schedules with the Simple Roll Schedule tool’s new overwrite option. Now, you can place a Simple Roll within an existing schedule, and LoanPro will automatically split the original schedule into two parts—one before and one after the new roll—so you can make changes without interrupting the overall schedule. This streamlines the process, so you no longer need to apply multiple adjustments when updating accounts.

Track and manage tasks with Smart Checklists

We’ve expanded functionality to Smart Checklists to manage your origination processes more efficiently:

- Customize checklist item statuses: You can now assign statuses like Received, In review, Approved, and Rejected to checklist items. These customizable statuses help you clearly define and track each step of the process, giving you more visibility into where each application stands.

- Automate status updates: Checklist statuses can now be automatically updated through rule-based workflows. For example, you can set up a workflow that changes the status when a specific action occurs, like when a document is received or reviewed. This not only saves time but also minimizes errors, ensuring applications move through the pipeline quickly and efficiently.

- Create event-based notifications (EBN): We’ve introduced event-based notifications for checklist status changes. Now, you can automatically trigger actions like sending webhooks or emails when a checklist status changes.

Bankruptcy monitoring via BankruptcyWatch

Our new integration with BankruptcyWatch provides a comprehensive set of bankruptcy management tools. Now, you can retrieve documents, verify court records, adjust account terms, and alter their communications to remain compliant with bankruptcy regulations.

Other news

- Automated Nacha and CPA-005 file delivery: You can now automatically generate encrypted Nacha and CPA-005 files and deliver them to your bank’s SFTP site. Then, when the bank sends LoanPro the return file, we can automatically update the relevant accounts and take servicing actions based on your custom business logic (like disabling AutoPays and contacting a borrower when payments fail). Read our articles on Nacha and CPA-005 files for the details.

- Bloom Credit integration improvements: We’ve improved the Bloom Credit integration to automatically sync updates to ECOA codes, phone numbers, addresses, and paid-off statuses when these fields are changed in LoanPro on a monthly basis. This ensures that Bloom has the most up-to-date borrower information. Learn more about these updates in our Bloom Credit integration article.

- Email UUID search in Connections: Previously, finding an email sent to a customer was a manual process that required navigating through several pages in LMS and Connections. Now, you can search for emails by UUID in Connections, making it much easier to locate specific emails and view their full details. UUIDs are visible in LMS under Customer Communications. To search by UUID, navigate to Connections > Contact Information > Email Services > Emails > Filter By: UUID. Read more about searching for emails by UUID.

- New DocuSign field types and signer role flexibility: Introduced new field types for DocuSign, including the date signed (automatically captures the borrower’s signature date), a text box, and a checkbox. We’ve also made it possible to assign Agent User and Source Company as signers, alongside Primary and Secondary Borrowers.

- Automation Engine trigger for funding transaction status updates: We’ve added a new trigger to the Automation Engine that activates whenever a funding transaction status is updated. This allows you to automate actions like sending notifications, making portfolio changes, or updating loan statuses. Read more on configuring automations.

- Canadian bank EFT institution numbers update: We’ve updated and expanded the list of Canadian bank institution numbers displayed within the payment profile creation iframe. This update refreshed existing institution numbers and added new options, ensuring a comprehensive and current list. Please note that this change does not affect any existing payment profiles.

- API token labels: You can now assign labels to newly created API tokens, making it easier to manage and identify them based on their specific use, such as access levels or integration details. Note this feature is only available for new API tokens. Existing tokens in your account cannot be labeled. Learn more about API token management.

- Queue automation assignment: We’ve introduced a Queue automation feature that assigns loans to agents using a round-robin method, which distributes loans evenly among available agents in a rotating order. A query runs daily at a specified time, identifying loans that meet your criteria and automatically assigning agents to them.

- Agent Walkthrough updates

- Walkthrough widget added to Smart Panel: We introduced dynamic Agent Walkthrough suggestions in the Smart Panel, allowing agents to quickly access the correct walkthrough based on loan attributes from any screen. This update reduces the number of clicks needed to find and start walkthroughs. To configure this, navigate to Settings > Company > Access > (New) Loan Views > Smart Panel. Learn more about how to set up Smart Panel walkthrough suggestions.

- Walkthrough tile added to Loan Summary: We added a dynamic Agent Walkthrough tile to the Loan Summary screen. Agents can now quickly access and start a walkthrough directly from the Loan Summary, improving efficiency in finding the right walkthrough. To configure this, navigate to Settings > Company > Access > (New) Loan Views > Views/Templates. Learn more about adding an Agent Walkthrough tile to your dashboard.

- Walkthrough eligibility icon: A new icon now appears next to Agent Walkthroughs that do not qualify for use on a loan within the Smart Panel and Loan Summary tiles. This update improves the agent experience by clearly showing whether a walkthrough can be opened for the loan in question.

- Smart Checklist updates

- Checklist tile added to Loan Summary: Loan Summary can now be configured to include a checklist tile, allowing agents to view and execute checklists directly from the page. Configure this by navigating to Settings > Company > Access > (New) Loan Views > Views/Templates.

- Checklist widget added to Smart Panel: Smart Panel can now include a checklist widget, allowing agents to review and execute checklists without needing to leave their current view. Configure this by navigating to Settings > Company > Access > (New) Loan Views > Smart Panel.

- Documents updates

- Documents tile added to Loan Summary: Loan Summary can now be configured to include a Documents tile, providing agents with quick access to loan-related documents directly from the summary screen. Configure this by navigating to Settings > Company > Access > (New) Loan Views > Views/Templates.

- Documents widget added to Smart Panel: Smart Panel can now include a Documents widget, allowing agents to access and view loan-related documents while performing other tasks. Configure this by navigating to Settings > Company > Access > (New) Loan Views > Smart Panel.

- Added statuses to Documents: We’ve introduced the ability to create and apply statuses to documents, allowing for more effective workflows like verifying an applicant’s identity or underwriting new loans. To configure this, navigate to Settings > Loan > Labeling > Document Statuses.

- “Additional” borrower role: We’ve added the ability to associate a contact with a loan but not mark them as a primary or secondary borrower. When adding a contact, you can now select the “Additional” role by clicking the green ‘key’ icon next to the borrower’s image. This feature is ideal for cases where an authorized user, attorney, or debt collection company needs to be associated with a loan but not assigned a primary or secondary borrower role.

- LOC Document and Smart Checklist statuses: You can now apply statuses to both documents and checklist items in your line of credit account. To configure document and checklist statuses, navigate to Settings > Loans > Labeling > Documents/Smart Checklists Statuses.

- LOC two-way SMS functionality added: We’ve expanded SMS to support two-way messaging for line of credit accounts. Read more about Interactive SMS.

- LOC Daily Maintenance tab enhancement: We’ve added the ability to view stats on when Daily Maintenance starts, stops, and the number of accounts maintained. Access this by following Profile Name > Account > Billing and Statements > LOC Daily Maintenance.

- LOC static carried balance fee for interest accrual: We’ve added the option to use a static fee for interest accrual on line of credit buckets instead of a percentage. You can now set bracket-based fee amounts that automatically apply to accounts with carried balances.

- Expanded Audit Trail for LOC: The Audit Trail for line of credit accounts now stores an expanded set of information, providing a more comprehensive view of account history. New events include details and timestamps for Quick Action activities, payment updates, credit limit adjustments, and more. For a complete list, reach out to your regular LoanPro contact.