Utah Business Names LoanPro Top Fintech for 2023 Innovation Award

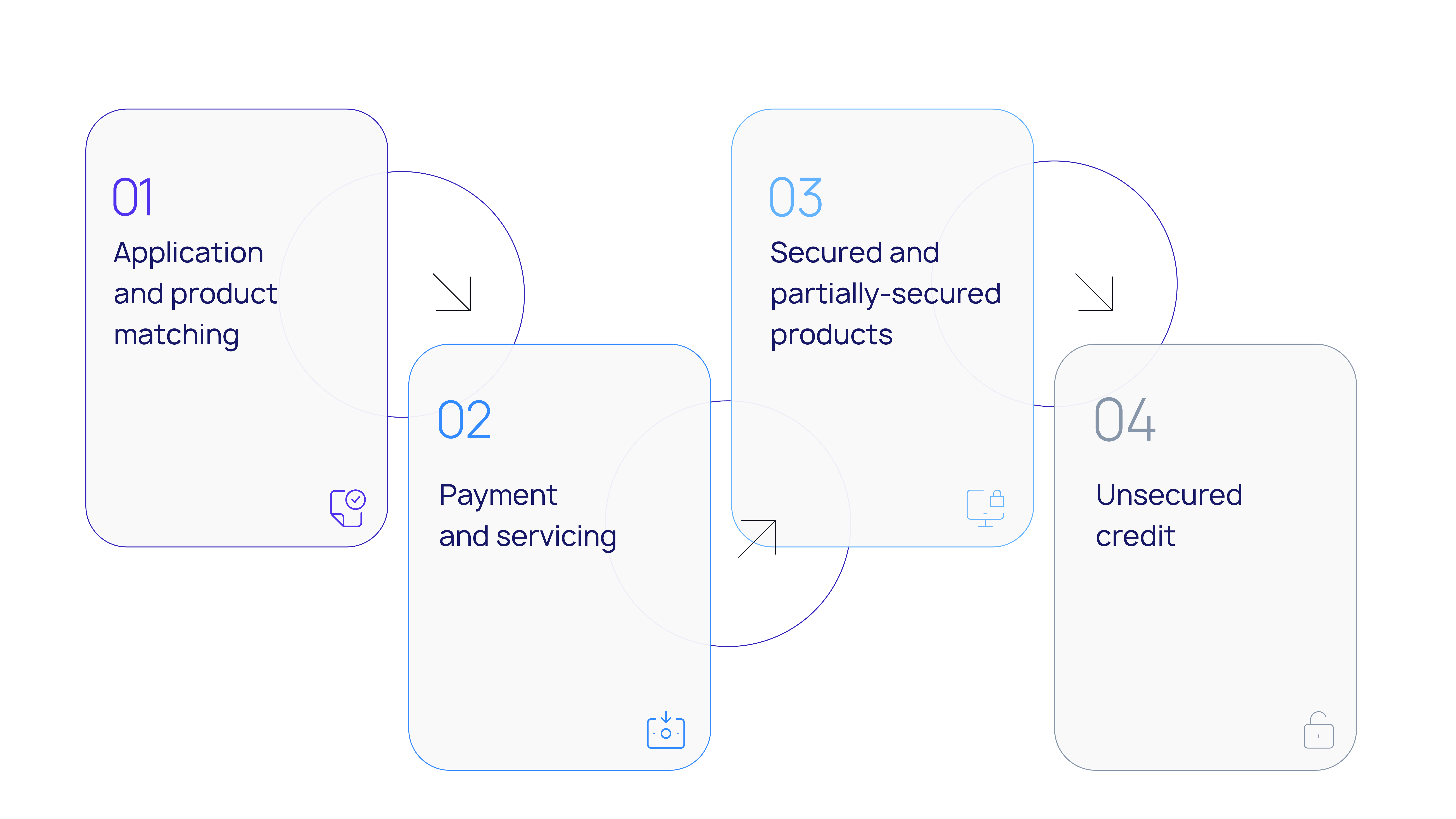

Every year, Utah Business honors technology innovators. LoanPro is honored to accept this year’s first place award in fintech from Utah Business for transaction-level credit, an innovation at the core of line of credit and credit cards. Transaction-level credit unlocks the ability to create and bring to market hyper-personalized, differentiated credit and credit card products.

Read the full article about the Utah Business award:

https://www.utahbusiness.com/here-are-the-honorees-for-the-2023-innovation-awards/