Webhooks 2.0 – Streamline with LoanPro’s premium webhooks

If you’ve scrolled through any sort of social media lately, chances are you’ve been served an ad about a software solution that will revolutionize the way you do business and increase ROI. We’re not here to speculate on the accuracy of said claim, but if you didn’t like that one, you probably scrolled by another SaaS ad a few swipes of your finger later. The SaaS industry has been growing at a blistering pace, and as of 2023, 56.7% of all SaaS companies in the world are located in the United States, with a market value of $108.4 billion.

SaaS is here to stay and has indeed changed the way that companies conduct business. In fact, as of 2021, an average of 110 SaaS apps are used per organization. With so much SaaS being introduced into business’ operations, it’s more important than ever to find a way to connect these systems together to promote unity, increase automation, and decrease time spent switching between tabs and windows on your PC. Lenders for example may want to connect their lending platform to Slack or another communication platform, and automatically send servicing managers a message when an account is 10 days past due. This can be done simply with webhooks.

What Are Webhooks?

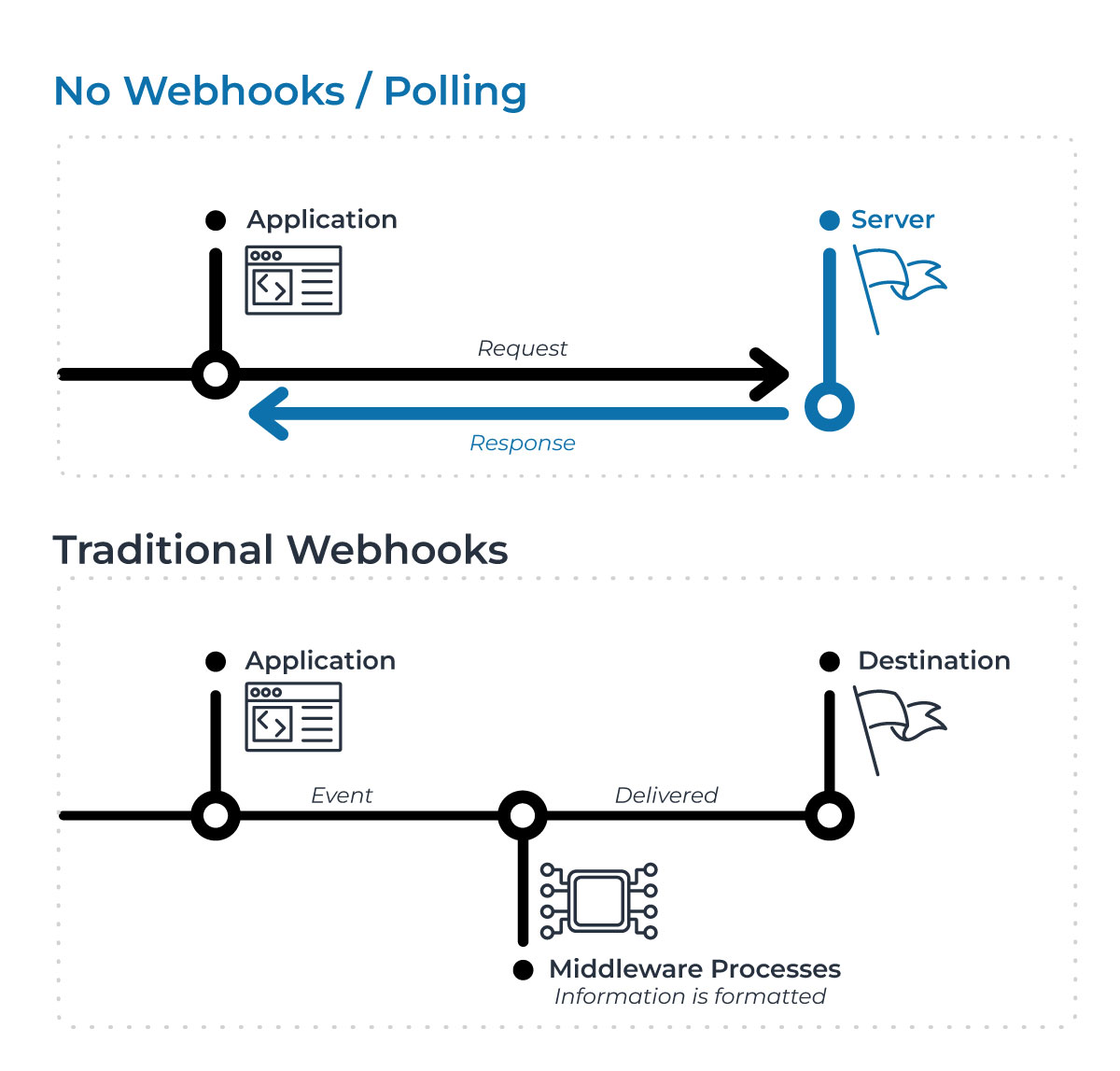

A webhook is a callback function that allows event-driven communication between two applications. In other words, webhooks are used to send information from one application to another whenever certain criteria are met within the sending application. This is a huge upgrade over another common method of receiving data called polling, in which a manual API call was made from the sending system to another system, asking if any new data was available. This process was burdensome. Manual processes aside, there was no guarantee that any new information was even available.

Webhooks solved this problem. Making a call only when certain criteria were met meant that your data was always ready.

The problem with traditional webhooks is how information in the payload (the content of your request) is formatted. Most systems don’t speak the same language. Imagine trying to ask somebody who only speaks Korean for a very specific and detailed favor, as an English speaker. The application sending the webhook needs to be formatted in a way that when the receiving application gets the data, it can read it and know what to do with it. This is usually done by purchasing outside software like middleware. Alternatively, you could spend $100k or so hiring an in-house dev team, or lose control and resources by outsourcing it to a third party.

It’s tricky to integrate systems, whether you’re using a homegrown system or trying to determine the software which is most beneficial to your company, not all integrations are created equal. A lot of systems restrict webhooks integrations to a very specific or predefined set of rules. Other systems will require the use of middleware to even make a webhook work.

Greater Connectivity with LoanPro’s Premium Webhooks

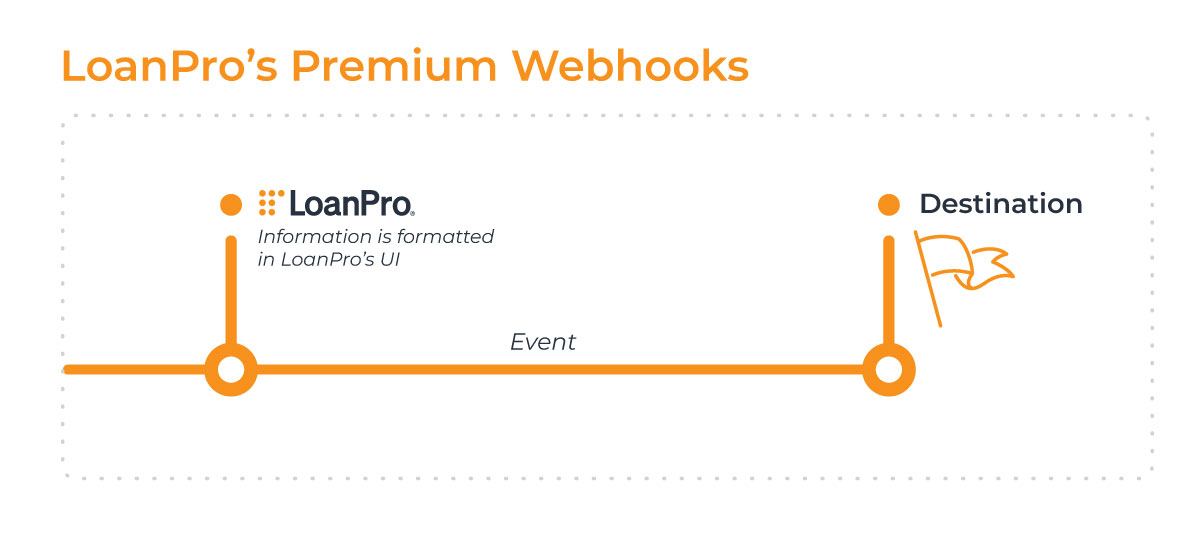

Have no fear, an easier way to maintain control and connect your application without the need for costly middleware or dedicated dev teams is here. The answer is LoanPro’s Premium Webhooks. LoanPro has solved the issue of developing a way to send information, and in most cases, without the need for outside development. With LoanPro’s premium webhooks you can:

- Eliminate the complexity of configuring messages between multiple systems

- Send HTTP request methods (GET, PUT, POST, DELETE) in whichever format you’d like

- Add any variables to the payload that you please, as well as format the payload information within LoanPro’s UI

- Gain real-time updates between systems for a consistent customer and back-office experience

- Improve customer experience with live loan updates

- Automate time-consuming manual processes downstream

The main differentiator for LoanPro’s premium webhooks is the ability to customize every part of your webhook with no dev team, and without ever leaving LoanPro’s UI, this includes:

- Headers – Who is sending the information? Headers are used to authenticate the sender and determine if the information is coming from a reliable source.

- Method – This states the desired action to be performed. In LoanPro users have access to GET (retrieve data) PUT (update existing data) POST (create new data) and DELETE (remove data) methods.

- Payload/Body – The payload or body is the content of your request. Generally, requests that add or update content will include a payload, but requests to retrieve or delete information will not.

LoanPro’s premium webhooks eliminate the complexity of configuring messages between multiple systems allowing for the seamless transfer of data between systems. Access to all these customization options means unlimited automation and a substantial amount of money saved on middleware and development.

Webhook Examples

Before we jump into some examples of how we’ve seen clients utilize our premium webhooks, keep in mind a lot of these functions (accounting, reporting, messaging) are able to be done natively within LoanPro with our robust set of lending tools, and integrations with many leading softwares. Suppose you have pre-existing processes that involve niche or homegrown software that you’d like to continue using. In that case, the majority of the time, premium webhooks offer a great way for LoanPro to connect to them.

Now that we’ve hyped them up, let’s temper expectations, premium webhooks are not an “end all be all” solution. Some of the more complex processes may still require middleware to an extent, but our premium webhooks are an effective solution for the majority of connectivity complications that we see lenders face.

Let’s look at some of the ways we have seen lenders who use LoanPro utilize our premium webhooks to automate tasks both in and outside of LoanPro.

- Update user information in a homegrown CRM to replicate changes made to the same user inside of LoanPro.

- Communicate with external tax services to stay compliant with state & country tax regulations and keep the tax amounts updated in LoanPro.

- Create auto pays automatically for processes that would normally have added a separate step for an agent to add or edit an AutoPay.

- Log a note with the action that just took place to eliminate the need for an agent to take the time to log one. This increases efficiencies for collections agencies and reduces redundancies for servicing agents, leading to higher loan-to-agent ratios and lower spending for clients.

- Send numbers to accounting systems (discount accrual, escrow information, payment information, etc.)

- Recalculate payment schedules automatically and adjust future payments.

These are just a few examples of the automations possible for your business by using LoanPro’s premium webhooks. Simply put, the possibilities are endless and give lenders more flexibility than ever before.

Conclusion

Though traditional webhooks seemingly solved the issue of connecting multiple systems, LoanPro’s configurable Premium Webhooks are the easiest way to connect your applications now, while also future-proofing your business for when more apps inevitably come. The tool decreases the need for additional software just to reformat information, saving you time and money. Additionally, webhooks unlock powerful automations, such as the ability to log autopay adjustments or update borrower profiles without the need for manual input.

Overwhelmed about setting up a webhook for yourself? LoanPro prides itself on having the brightest lending and tech experts in the business and includes webhook set up as part of our support offering. Our people are specially trained to ensure your webhooks and automations are configured to your specific needs. To learn more about our premium webhooks as well as other features that streamline your lending operations, secure a demo with one of our platform experts.