Open-End Credit Compliance Summary

Introduction

Working with open-end credit comes with a lot of rules, many of which come from TILA and Regulation Z, its implementing regulation. These rules include a number of required disclosures, requirements for accepting payments, and guidelines specific to credit cards. Below is a summary of some main points to be aware of when it comes to open-end credit requirements, along with how LoanPro’s features and tools can help reduce risk for our customers.

Open-End Credit Requirements

- Anytime a new account is being created, creditors have to provide their customer with comprehensive account opening disclosures.

- Open-end credit accounts require a period statement to be sent out for every billing cycle. For credit card accounts, they must be sent or delivered at least 21 days before the next due payment. For non-card credit accounts, statements should be sent or delivered a minimum of 14 days before the next due date.

- If a significant change is made to an account’s terms, a written notice of the change should be sent at least 45 days before the date the change goes into effect, unless the consumer agreed to the change beforehand, in which case, the notice is still required, but may be mailed or delivered as late as the effective date of the change.

- Payments must be credited the day they are received unless a delay in crediting won’t cause any kind of charge. If the creditor doesn’t receive or accept payments by mail on a due date they can’t treat the payment as late if it’s received on the next business day.

- Creditors can’t impose any separate fee for a consumer to make a payment by any method (mail, electronic, or phone payments) unless said payment method involves an expedited service.

- If an account has been inactive for 3 or more consecutive months, the creditor may terminate an account. An account qualifies as inactive if no credit has been extended and there is no outstanding balance.

- In the case of estate debts, a statement of the balance needs to be provided to the administrator within 30 days of receiving a request.

- A credit card should not be issued to any person unless in response to an oral or written request or application, or in the case of a renewal or substitute for an accepted credit card.

- If a card issuer has a cardholder’s funds held in deposit, they can’t use those funds to offset the cardholder’s indebtedness under their credit card plan.

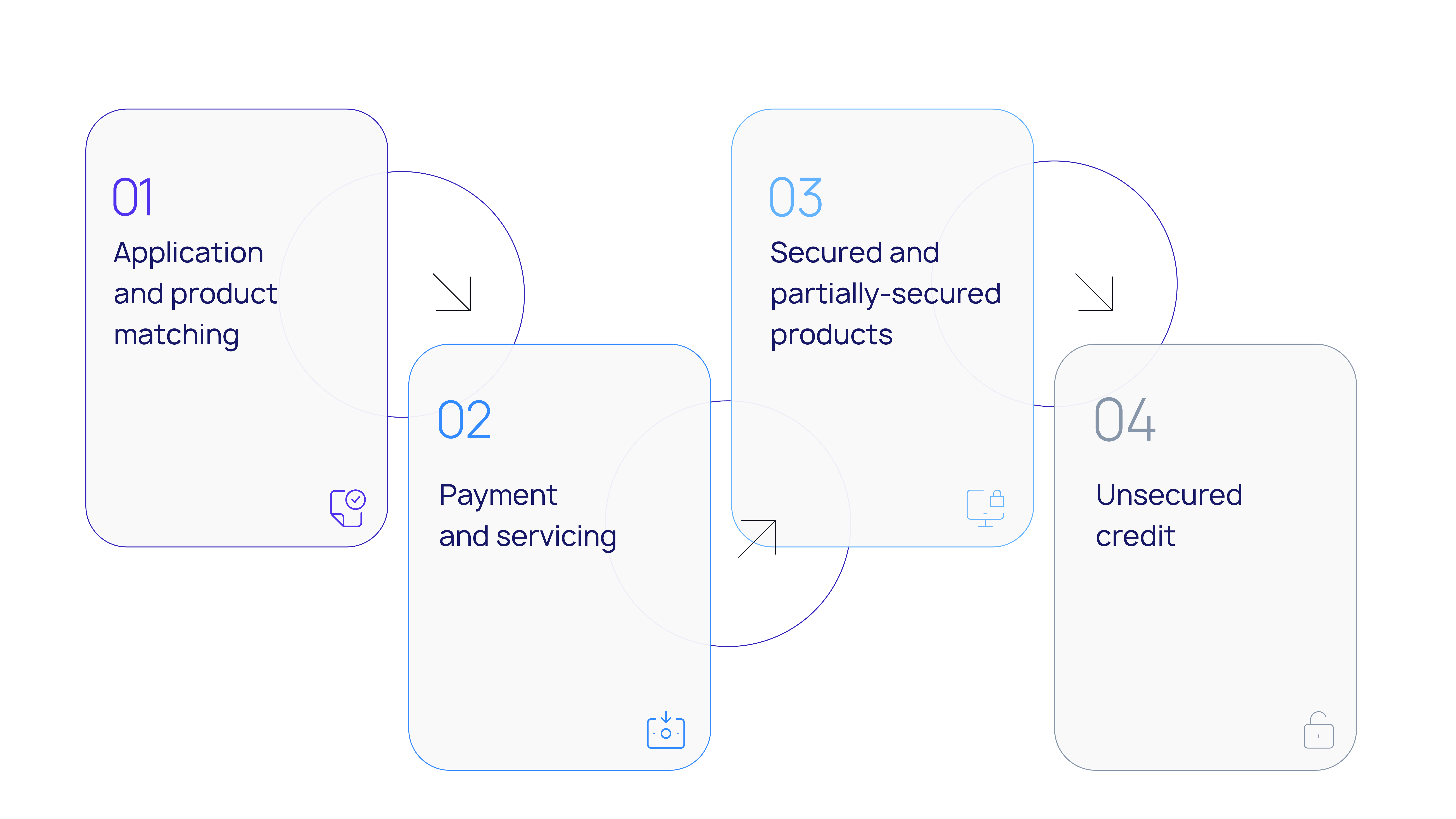

LoanPro Solutions

- LoanPro’s Communication Suite allows customers to use multiple communication methods and automate customer notifications and disclosures for reduced risk and agent convenience.

- Notice and disclosure forms that follow safe harbor templates are available as Dynamic Templates.

- LoanPro allows you to sort loan and line of credit accounts Smart Tags based on specific criteria.

- Agent Walkthroughs ensure that agents are guided through each step of complex processes, increasing compliance and reducing the time to complete tasks in the system.