How to Choose the Right Auto Finance Software

In the auto lending industry, numbers are everything. The more customers you lend to, the more revenue you can bring in. But, if you’re not working with a seamless loan management process, you’re never going to sustain a large number of borrowers, which means you’re not going to grow.

The reality is that there are many tedious, but important, tasks that suck up your time— from creating accounts and posting payments, to sifting through data to find the info you need. If you’re constantly in the weeds trying to manage your loans, you’re missing out on the revenue-earning potential that an optimized auto loan management software provides.

To instantly improve productivity and mitigate risk, you need auto lending software that does the heavy lifting. Given that the global auto loan origination software market was valued at $753.7 million in 2024 and is projected to grow at a 7.9% CAGR, the importance of choosing the right solution has never been higher.

Let’s dive into what you should consider when choosing the right automotive lending software for your business.

Part 1: Determine Your Priorities for Auto Finance Software ROI

As an auto lender, your goal is high-volume lending combined with tight risk management and a positive auto loan customer experience. Your choice of auto finance software must directly address these goals.

Here are the features and benefits that define a modern automotive lending solution:

Cross-Selling & Portfolio Growth

If you aim to increase revenue with products like VSC (Vehicle Service Contracts) or GAP insurance, your auto loan software needs native cross-selling features. These functionalities allow you to market additional products to existing customers efficiently and monitor which customers converted the most.

Automated Workflows & High Efficiency

If your team spends time on manual tasks like tracking payments, sending notifications, or leafing through data, productivity suffers. Automation for auto loan compliance and servicing tasks is crucial. Intelligent automation can bring up to 225% ROI in the first year and achieve a 50% reduction in operational costs by eliminating these workflows.

Frictionless Customer Experience (CX)

You must make the initial application process easy to maximize account openings. The right auto loan financing software should allow borrowers to apply via mobile and provide access to dynamic documents and real-time tracking through a customer portal. Digital loan origination volume has surged, reflecting a 165% increase in digital adoption since 2020.

Integrate Multiple Apps & Consolidate Data

If your organization relies on information from third-party tools (KYC, credit bureaus, DMS), your auto finance company software must seamlessly integrate these sources into a single view. This flexibility is essential for creating a highly customized auto lending platform that works with your existing tech stack.

You can narrow your search down with more specific goals from each of the points above. In doing so, you can determine the main obstacles your organization faces and then choose the best loan management software based on your needs.

Part 2: Identify the Different Types of Auto Loan Software Platforms

Knowing the types of auto financing software available will help you decide the best solution for your organization.

Type #1: Auto Loan Origination Software

The first is auto loan origination software. This type of auto financing software will help with the process of obtaining a loan, such as assessing credit risk during the screening process. A good loan origination platform ensures that your organization grants loans to the best possible borrowers.

Type #2: Auto Loan Servicing Software

The second is auto loan servicing software, which is designed to help you collect payments from customers and distribute them to the involved parties.

A loan servicing solution solves problems such as dealing with late payments and ensuring customers have all the information they need to keep up with their loans. It makes the process of loan management far easier for auto lenders and enables you to service hundreds or even thousands of loans with a small team.

This software will automatically contact borrowers if they miss a payment. It also provides options to get the borrowers back on track with their payments.

Do You Need a Unified Platform?

Both platforms are critical, but they handle different parts of the loan lifecycle. When choosing the right loan software platforms for auto lenders, you can choose a solution that offers both loan origination and servicing features on a single core. This eliminates friction points between departments and ensures data integrity. For auto lenders that outsource origination (like many auto dealership financing software users), a robust loan servicing solution might be the main priority

From these two types of software solutions, you’ll be able to choose the auto lending platform that fits your business like a glove.

Part 3: Essential Features for Auto Lending Compliance and Risk

As you choose your platform, look for features that directly address the industry's largest pain points: elevated risk and complex regulation.

1. Advanced Risk Management and Pricing

The need for proactive risk mitigation has never been higher: Subprime auto loan delinquencies hit a record 6.6% in January 2025, and auto loan debt exceeds all other household debt categories except for home mortgages.

Your auto lending software must:

- Utilize Risk-Based Pricing: Automate the calculation of precise loan terms and interest rates based on the borrower’s creditworthiness and risk score.

- Scrutinize Data: Leverage AI's ability to analyze behavior dynamically and reveal trends that predict loan performance over time, reducing the risk of errors that could reject worthy applicants.

2. Automation for Auto Loan Compliance

Auto lending compliance is a massive burden, compounded by the rising volume of regulatory updates. To avoid human error and fines that "routinely run in the millions", your software must automate execution of decision rules.

Compliance regulations specific to the auto industry include:

- FTC CARS Rule: This new rule prohibits deceptive practices and requires extensive disclosure, making automated document generation and consent capture essential.

- TILA (Truth in Lending Act): Requires accurate, written disclosure of the APR, monthly payments, and other details.

- SCRA (Servicemembers Civil Relief Act): Guarantees military members the right to terminate or extend vehicle leases.

- UDAAP (Unfair, Deceptive, or Abusive Acts and Practices): The CFPB is heavily focused on UDAAP in auto lending, scrutinizing add-on products and misleading "as low as" APR marketing.

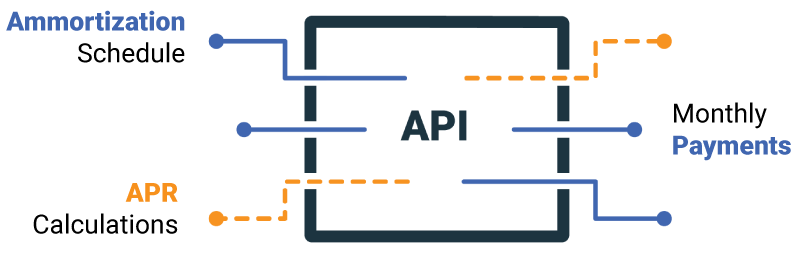

3. Cloud-Based and Developer-Friendly API

A powerful auto loan servicing software platform must support continuous innovation:

- Cloud is Non-Negotiable: The cloud-based segment already dominates the market with 72% market share. Cloud solutions offer better scalability, cost-efficiency, and security than legacy on-premises software.

- Developer-Friendly API: If the platform is not fully comprehensive, a developer-friendly API allows you to seamlessly connect it with third-party apps and integrate multiple tools. This flexibility ensures you can get the most out of your automotive finance software and reach all those revenue-growth and auto loan customer experience goals.

Image showing integration with third party apps

Conclusion: Achieve Success with a Unified Auto Loan Management System

Choosing the right auto loan management software is crucial to the success of your business. By sending out automatic notifications and scheduling loan collections on time, you can run a tight ship, which will help your team and your customers.

LoanPro’s platform provides a unified auto lending solution for both origination and servicing. You can automate virtually any loan management task you need to improve productivity and efficiency. More importantly, its API allows you to create an auto loan management system customized to your needs.

Curious how these strategies impact the customer experience? Download our one-pager to see how top automotive lenders are elevating collections today.