Game-changing self-serve options through LoanPro’s customer portal

Introduction

In the competitive lending and credit landscape, a delightful customer experience is key to differentiating companies and products. LoanPro understands this and is excited to offer an all-new customer portal in Q2 of 2024, unlocking best-in-class self-serve options that help lenders stand out. The new portal not only boasts a modern, intuitive design, but also introduces themes to offer users a personalized and engaging financial management experience. Let’s delve into the features that make LoanPro’s portal a game-changer for customer experience through robust self-serve options.

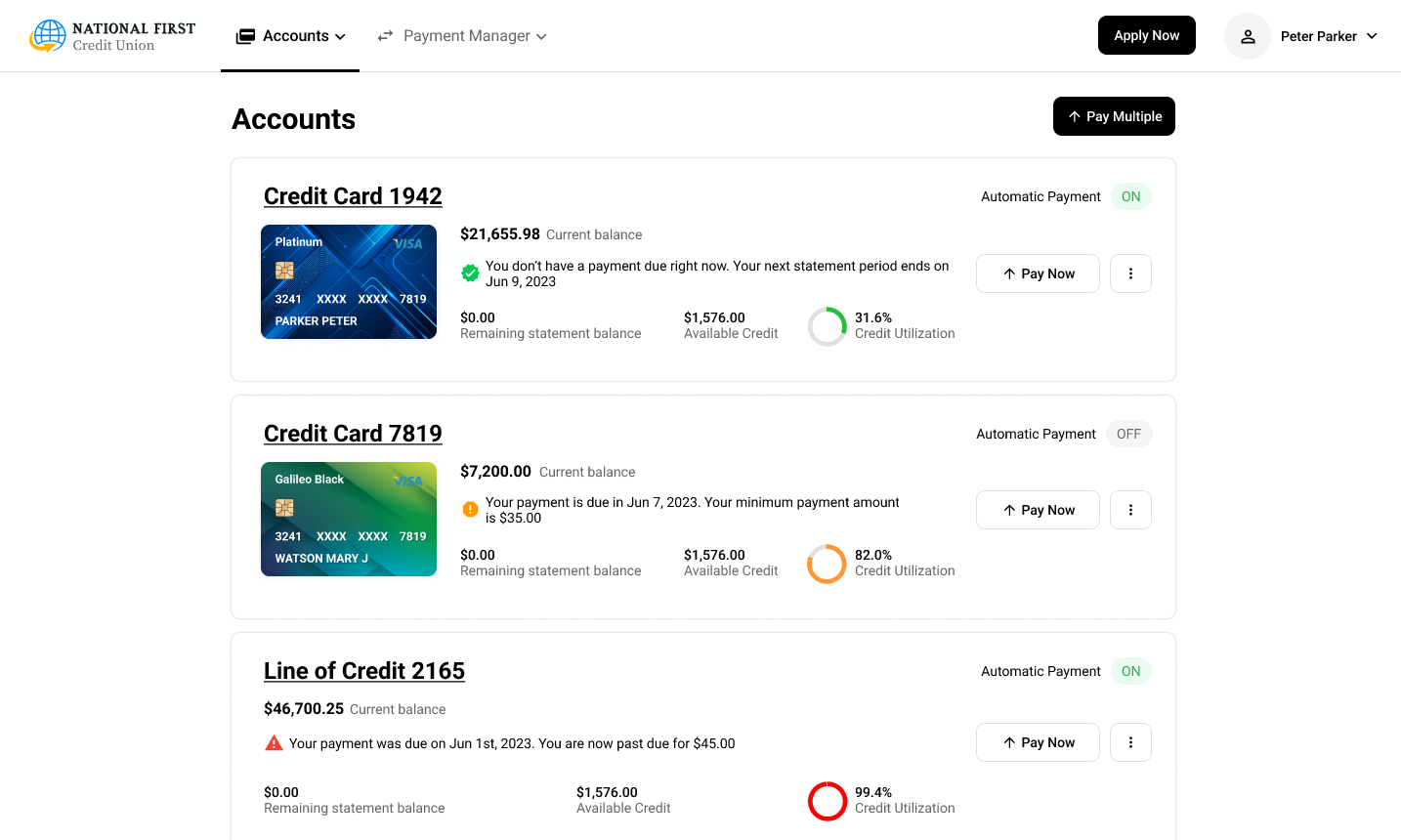

Screenshot of the LoanPro customer portal

Overview

The new customer portal provides a single point of access for a customer’s loans, lines of credit, and credit cards with tailored functions for each account type. It offers convenient, unifying features like the ability to make a single payment that applies towards all account balances, saving customers time and providing a next-level experience.

While other online portals offer basic functionality, the LoanPro portal will provide customers all the features they need to self-service their loans and lines of credit. Much more than an attractive interface, it’s a powerful servicing tool with lending efficiency at its core. We are confident that lenders who implement the portal will see a noticeable decrease in servicing calls and a significant savings in agent time. The new customer portal will include all of the following options to help drive operational efficiency.

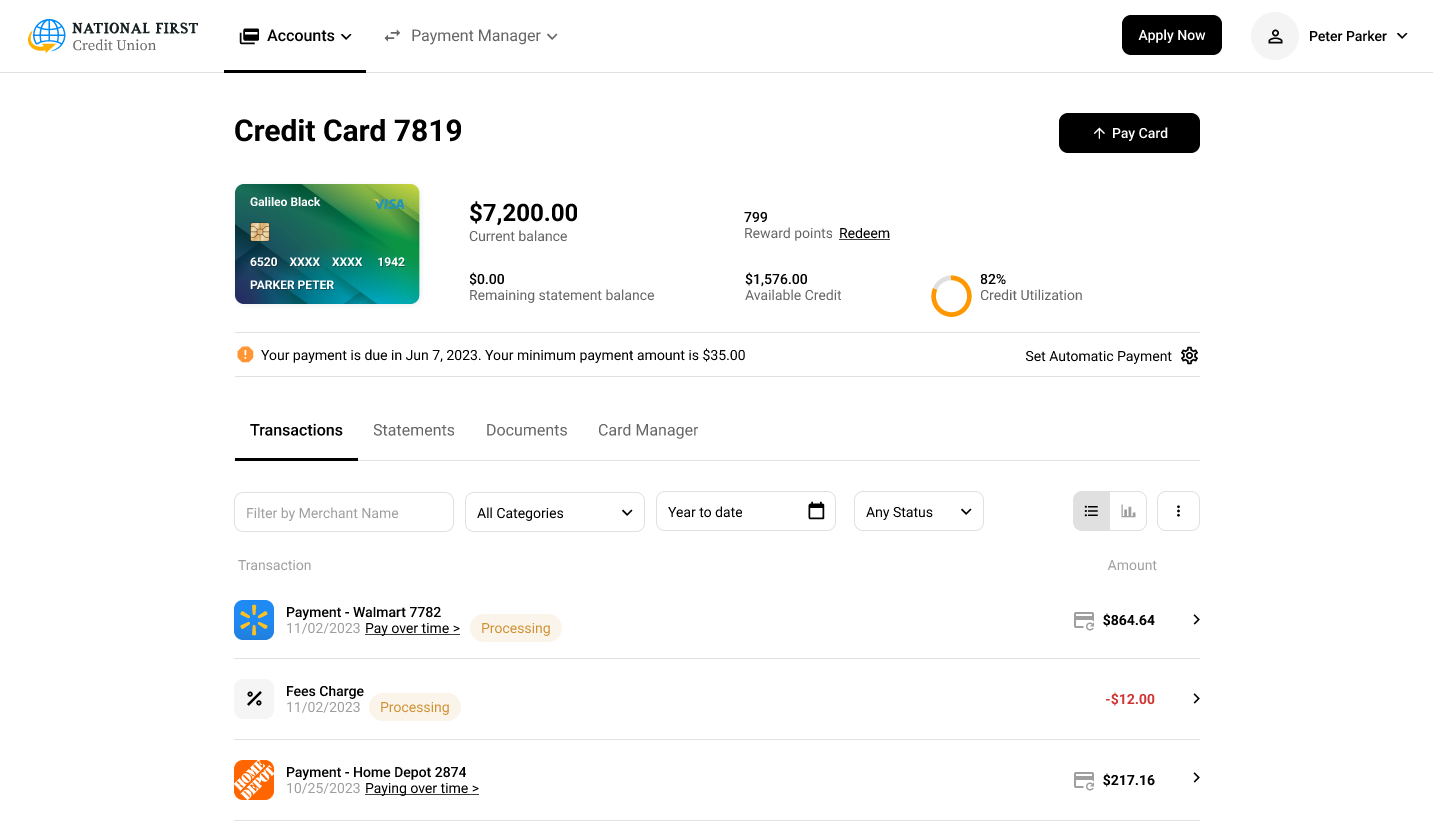

Screenshot of the LoanPro customer portal

| Standard Features | Advanced Features |

| View account data | Account statistics and analysis |

| Make a payment | Transaction details |

| View complete payment history | Single payment for multiple accounts |

| Enroll in AutoPay | Upload documents |

| View & download statements | Add collateral items |

| Change password | Credit card controls |

| View collateral information | Credit card spend analysis |

But that’s far from everything the portal has to offer. It will also work in coordination with the new LoanPro ticketing system (to be released in Q3 of 2024) to streamline and automate many lending tasks. When a customer submits a ticket from the customer portal, LoanPro’s Automation Engine can be used to escalate the ticket, or run the ticket through a completely automated process.

For example, a ticket could be added to the customer portal to enable customers to request an SCRA adjustment. Once submitted, LoanPro’s automations and webhooks could query the military database, confirm a customer’s active-duty military status, and automatically adjust the interest rate to meet SCRA requirements.

Portal themes

Themes control not only the look & feel, but the available functionality of the customer portal. Multiple themes will be available at launch, and LoanPro will continue to add themes over time. Choosing the right theme will help lenders provide the experience that best fits their customers’ needs, and the functions lenders want to provide. And, of course, the portal can be branded with the lender’s logo and brand colors.

The theme will control every part of the portal, from the login page to the payment history view. Lender’s can choose the theme that provides an optimal experience for the type of loans they give.

Conclusion

LoanPro follows a commitment to provide customer delight. We anticipate that this customer portal will not only help us delight our lenders, but that it helps them delight their customers. The LoanPro’s customer portal will be one of the best servicing tools in a lender’s arsenal to drive efficiency and level up customer satisfaction.

Would you like to learn more about how the new customer portal can drive servicing efficiency for your company? Click here to chat with a member of our team.