Driving growth in automotive origination

Origination

We might talk about consumers ‘shopping for loans’, but whatever credit product they pick, it’s always incidental to the actual goods and services they’ll use it to purchase. Consumers don’t value money in a vacuum; no one is taking out a loan so they can stare at a big pile of cash like Scrooge McDuck. They see the money as an instrument to achieve their underlying financial goals. In some cases, those goals are diffuse, spread out among multiple purchases and merchants. In others, the goal is direct: student loans pay for your degree, BNPL products pay for your retail purchase, and automotive credit products get you a car.

While some credits see themselves as providing a more abstract value to borrowers (like access to credit or financial freedom,) automotive credit providers understand the direct connection between their financial product and the thing borrowers actually want. Automotive loans, leases, and lines of credit provide convenience, but they’re a convenient means to the ultimate end of the automobile itself. Borrowers want a car (or trailer, boat, etc.) and they’re comfortable with using credit to get it.

When creditors understand the relationship between the core product (a vehicle) and the financial product that accompanies it, they understand how their borrowers view the origination process. After doing their research, reading reviews, test driving a few cars, and maybe negotiating to get a few upgrades, they’ve finally made the decision to buy. From their perspective, any time spent underwriting, contracting, or negotiating financing terms is at best a formality they have to endure. At worst, they may see it as one last trick from the dealership, trying to sneak in some interest or fines before they can drive off the lot. (Insert your own joke about a used car salesman here.)

Streamlining automotive origination

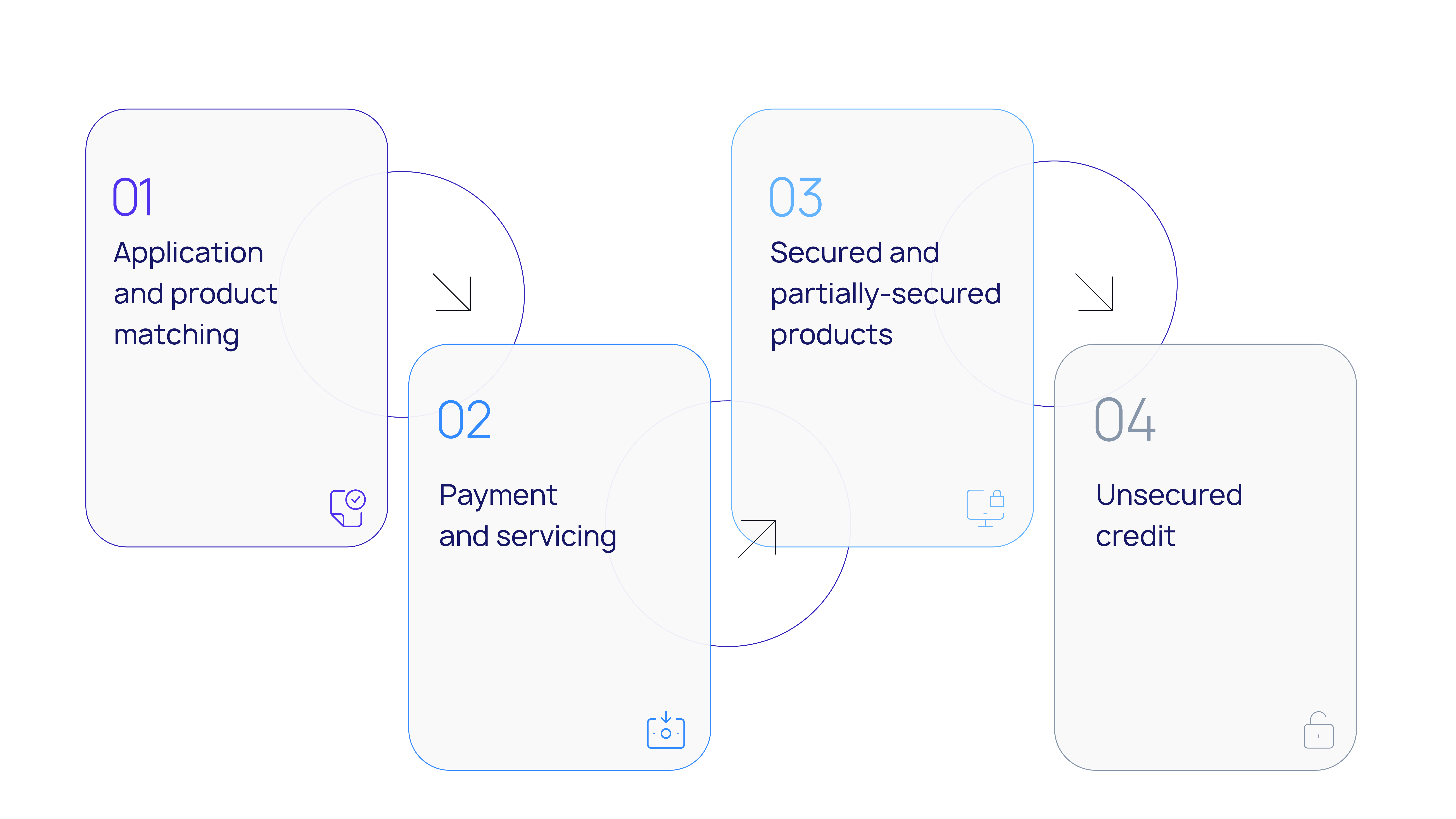

To start things off on the right foot with borrowers, streamline your origination process with two key technologies:

- Whether you’re running a Buy Here, Pay Here auto lot, a related finance operation, or any other model, you can use modern APIs and data solutions to condense the long forms and wait times into a few simple questions. Automotive lenders using LoanPro, for example, can connect their operation to third party data sources, allowing them to instantly perform KYC and underwriting from just basic identity information. From there, LoanPro can feed data to your decisioning engine and calculate out a full amortization schedule, personalized to the borrower’s creditworthiness and repayment preferences.

- Drafting contracts through LoanPro can be just as simple with Dynamic Templates. You can merge your own custom contract templates with personalized borrower data, both the information they gave you and what you pulled from third-party sources. In just seconds, you’ve gone from asking a few simple questions to printing a contract for the applicant to sign.

This benefits both you and your borrowers. First, your customer experience starts off strong. Borrowers will leave the lot happy, thinking about how easy it was to get their loan as they drive their new car off into the sunset. At the same time, you’ll save your own time. Instead of tying up the dealership’s employees in TILA paperwork, they can send customers on their merry way and focus on the next deal.

Re-origination

Vehicles, as any motorist knows from personal experience, are not just one-time expenses. From filling up a tank of gas to major repairs, cars (and motorcycles, boats, or whatever other automotive you’re financing) require a bit of upkeep. Your customers will almost certainly be spending their money on that upkeep, and there’s a very good chance they’ll finance it through a credit card or another credit product. This is a golden opportunity to deepen your relationship with the borrower, building loyalty and fostering long-term retention.

Expanding credit with advancements

Many automotive lenders offer advancements, where an existing customer can access additional funding for upgrades, customization, or repairs. They may offer this service, but if borrowers aren’t aware, they’re not going to get much use out of it. As borrowers settle into the routine of making repayments, use your regular communications to remind them of your advancement offerings. When the time comes to fix a cracked windshield or get those cool spinner rims, your name will be the first thing that comes to mind.

Complementing credit with cards

For smaller purchases like fuel and regular maintenance, automotive lenders could extend credit cards. LoanPro’s unique card technology, transaction level credit™, would allow you to give preferred interest rates and abatement on purchases in those spending categories, making the card a top-of-wallet choice for all their automotive needs.